- Need2Know, by Cheddar

- Posts

- Big swings keep rocking Wall Street as S&P 500 goes up 2%, down 3%

Big swings keep rocking Wall Street as S&P 500 goes up 2%, down 3%

Plus: $236M Portrait Sale Ignites a Roaring Art Market Comeback

Greetings N2K reader!

This week’s world famous News Haiku™ competition is about the last U.S. penny ever being minted (it’s true, they are no more!). Vote on the winner in today’s poll below!

—Matt Davis, Need2Know Chedditor

News You Need2Know

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter

$NVDA ( ▲ 1.02% ) $UBS ( ▲ 0.57% ) $BTC.X ( ▲ 0.15% ) $HOOD ( ▲ 0.61% ) $COIN ( ▲ 3.26% ) $BAC ( ▲ 0.55% ) $WMT ( ▼ 1.51% )

Big swings keep rocking Wall Street as S&P 500 goes up 2%, down 3%

Take back what I said yesterday about checking your 401(k). Wall Street continues to experience roller-coaster fluctuations as the S&P 500 $SPX ( ▲ 0.69% ) swung from a promising 2% rise to a steep 3% drop from its heights yesterday. The market’s instability stems largely from concerns over tech giants like Nvidia $NVDA ( ▲ 1.02% ) , whose stocks have been riding the AI momentum wave. Despite promising financial forecasts — “it is very hard to see how this stock does not keep moving higher from here,” said analysts at UBS $UBS ( ▲ 0.57% ) — the specter of an AI bubble looms large. Investors worry whether hefty investments in AI technology will genuinely yield the projected economic gains.

The crypto market isn’t faring much better; Bitcoin $BTC.X ( ▲ 0.15% ) saw a sharp decline, dragging down associated companies like Robinhood $HOOD ( ▲ 0.61% ) and Coinbase $COIN ( ▲ 3.26% ) by 8.4% and 6.9%, respectively. A recent Bank of America $BAC ( ▲ 0.55% ) survey amplified the jitters, highlighting a record percentage of investors who felt companies might be “overinvesting,” raising fears of an AI bubble as the number-one market risk.

It wasn’t all gloomy, however, as Walmart $WMT ( ▼ 1.51% ) emerged as a beacon of success. Delivering robust sales and profits that surpassed Wall Street expectations, the retailer saw its stock climb by 5.7%.

Song of the day: Oscar Jerome, ’Give Back What You Stole From Me’

This song came out in 2020. It’s just one of my favorites. Let’s call it “political jazz,” shall we? Or shall we not? It’s just a great soundtrack for the stock market when you’re tempted to check your 401(k) this morning.

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

*This counts as journalism, right?

ADVERTISEMENT

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Nvidia shattered earnings records — so why did the stock drop the next morning?

"The top takeaway it was another monster quarter. And next quarter is gonna be another monster quarter," Adam Levine with Barron’s said. "Demand is insatiable for their equipment and for the stuff that runs on their equipment at the cloud that they sell to. So demand's insatiable right now, and it's not going anywhere in the short term."

Despite the stellar performance, the stock was trading under its fifty-day moving average ahead of earnings, reflecting a unique standard set for the AI leader. As Levine notes, "They’re kind of held to a different standard than everybody else... it's not enough that they beat expectations. They have to beat a lot and they have to give great guidance."

Levine also addressed the bearish headlines surrounding major investors like Peter Thiel, Michael Burry, and Softbank, arguing their moves against the firm were often misread or "overblown." He explained that Softbank sold shares to fund a massive investment in OpenAI, while Peter Thiel’s fund position was small and subsequently exited. "I didn’t take those very seriously, but obviously they drove sentiment," he said.

Ultimately, Levine believes the earnings report reminded everyone that "the demand is very real and it's not going anywhere anytime soon," though he cautions the biggest long-term threat is macro.

Basically, the stock market is all about emotions. And numbers. And emotions. And numbers. #NotFinancialAdvice

Quote of the Day

Whatever you eat, a $200 lunch or a $2 hot dog, the results are the same, toilet-wise.

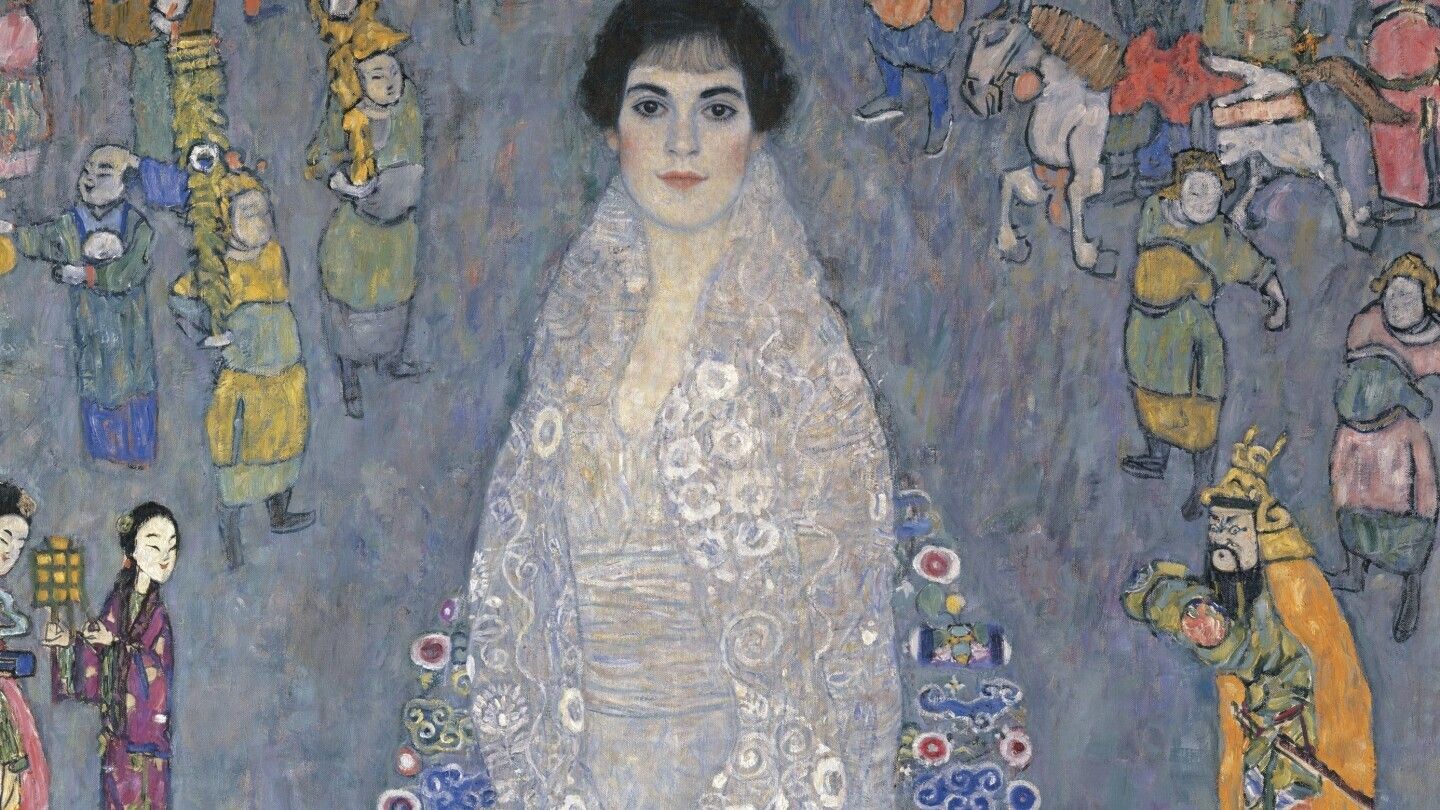

$236M portrait sale ignites a roaring art market comeback

Jaw-dropping prices closed on the art market this week as Gustav Klimt’s Portrait of Elisabeth Lederer shattered records, selling for a staggering $236.4 million at Sotheby’s in New York. The iconic work, painted between 1914 and 1916, holds not just artistic significance but also historical weight. During the Holocaust, Lederer claimed Klimt—who wasn’t Jewish and died in 1918 — was her father to escape Nazi persecution, a daring move that shielded her while other family treasures were looted. The piece, once part of the late billionaire Leonard A. Lauder’s collection, now breaks the record for modern art, overtaking Andy Warhol’s Monroe painting, which sold for $195 million in 2022.

The surprises didn’t stop there. Maurizio Cattelan’s 18-karat gold toilet, aptly named America, went for $12.1 million. Known for his cheeky, satirical style, Cattelan has called the piece “an incisive commentary on superwealth,” quipping, “Whatever you eat, a $200 lunch or a $2 hot dog, the results are the same, toilet-wise.” The flashy commode has already made headlines in its short existence, being displayed at the Guggenheim, offered to President Trump, and even stolen in England. Sotheby’s — who presumably took a percentage of the sale — described the toilet as a profound reflection on the intersection of art and commodity.

Should you check your 401(k) today?

👎️

NO.

If you like this newsletter, why not forward it to a friend so they can subscribe here? If you don’t, why not forward to an enemy? Thank you!

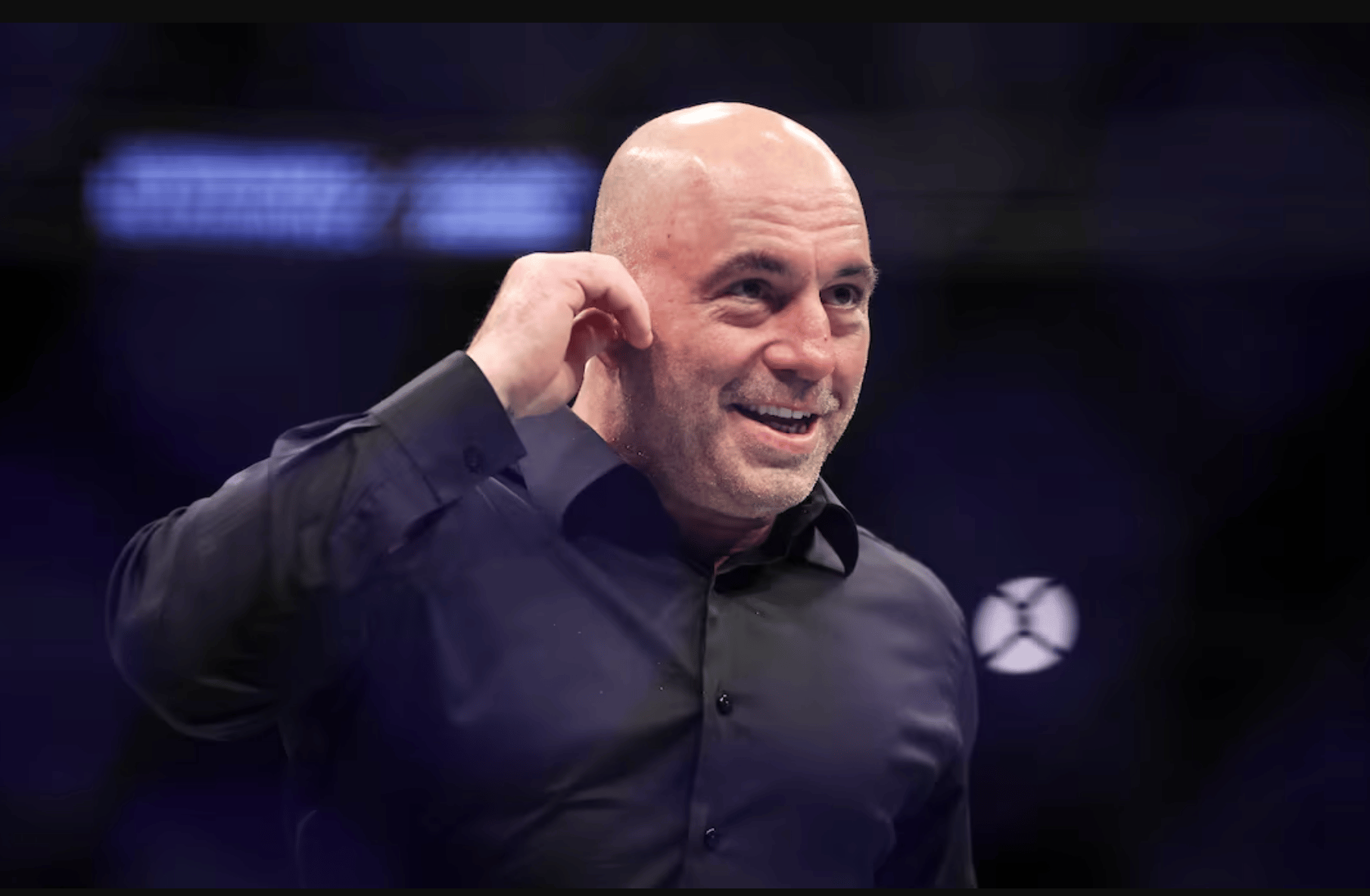

Joe Rogan topples ‘The Daily’ in Apple’s podcast ranking

Apple has unveiled its most popular podcasts of 2025, with The Joe Rogan Experience claiming the top spot, dethroning The Daily from the New York Times. Based on global listenership data, Joe Rogan’s show dominated charts, fueled by notable episodes like his discussion with Elon Musk, which ranked as the fourth-most listened-to episode of the year. As Rogan’s exclusivity contract with Spotify ended early in 2024, his reach expanded, reportedly backed by a massive $250 million deal.

While Rogan may reign supreme, The Daily remained a strong contender, securing second place, and The Mel Robbins Podcast climbed to third with its empowering and motivational episodes.

Have Bob Iger’s acquisitions kneecapped Disney’s future?

This is the latest in our weekly series of guest columns on the business of movies with Grant Keller.

Disney CEO Bob Iger can’t stop buying companies. Is it always strategic for him to do so, or is his shopaholism hamstringing the company for the future?

One of Mr. Iger’s first major actions as CEO of Disney was to bring Pixar back to Disney after their initial five-film distribution contract was up. He succeeded, and Disney purchased Pixar for $7.4 billion. The acquisition resulted in an immediate creative and financial boom with the likes of “Wall-E,” “Ratatouille,” and the best pictures nominees of “Up” and “Toy Story 3.”

Then, for decades, Disney had been trying to break into the young boys market, throwing anything at the wall from “Prince of Persia” to “John Carter” to see what stuck. When nothing did, Iger purchased Marvel. After that, he bought Lucasfilm, gaining the rights to “Star Wars.” The boys’ market was now Disney’s.

Marvel kept climbing until its eventual apex of “Avengers Endgame” briefly being the highest grossing film of all time and Disney’s era of “Star Wars” burst onto the scene with “The Force Awakens,” which is still the highest grossing movie domestically, even a decade later.

Then things started to fall apart…

Poll of the day: Haiku of the week!

The news story of pennies no longer being minted is our most haiku-worthy yet, it seems. We had more than 60 entries in this week’s World Famous News Haiku™ competition, of which these are, in my humble opinion, the best four. Of course, my humble opinion is not terribly humble really since I am now GOD of the News Haiku competition, selecting the contenders for the audience vote.

Thank you all very much for your entries. They were all excellent! But which was the most excellent? You choose:

Poll results: You’d like Pete Davidson’s truck!

We asked: Would you like to win Pete Davidson's truck?

🟨🟨⬜️⬜️⬜️⬜️ No, I'd rather win his Staten Island Ferry (80)

🟨⬜️⬜️⬜️⬜️⬜️ No, I'm nervous it would start with the truck and pretty soon we'd be dating. Again. (33)

🟨🟨🟨⬜️⬜️⬜️ No. I'm nervous because Pete Davidson. (87)

⬜️⬜️⬜️⬜️⬜️⬜️ Yes. I would lurve it for all of the reasons above, only opposite. (24)

🟩🟩🟩🟩🟩🟩 Yes. It looks like a nice truck and it's for charity. (187) 411 Votes

via @beehiiv polls

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |

Need2Know is covered by Cheddar’s Terms of Service.