- Need2Know, by Cheddar

- Posts

- How to AI-proof your job

How to AI-proof your job

If you still have one. Plus: Markets rise on mixed employment data, some of which the president posted early on social media.

Today’s newsletter is brought to you by:

Happy Monday, N2K reader!

Kaitlyn Pino won last week’s world-famous news haiku competition™ on the Venezuela sitch, with this little beauty:

Iraq two point oh

but with no hidden agenda

oil oil oil oil oil

Congratulations, Kaitlyn! Here’s your appropriately celebratory gif:

“I have a world famous haiku competition in me. I want no one else to succeed.”

And here’s how the rest of the finalists stacked up (it was a neck-and-neck race at the end there, Kaitlyn!)

🟨⬜️⬜️⬜️⬜️⬜️ Venezuela now | That corrupt leader is gone | Everyone profits ~ Bob Andersen (56)

🟨⬜️⬜️⬜️⬜️⬜️ I’d like to think that | It’s our chance to make progress | Replacing crude ways ~ Jon Daigle (45)

🟩🟩🟩🟩🟩🟩 Iraq two point oh | but with no hidden agenda | oil oil oil oil oil ~ Kaitlyn Pino (176)

🟨🟨🟨🟨🟨🟨 Coveting oil, we launch a strike in the night. Greenland, you are next. ~ Joan Benson (173)

🟨🟨🟨⬜️⬜️⬜️ Dancing in the streets! This is highly illegal! Depends on news source. ~Caroline Von Hayden (89)

539 Votes via @beehiiv polls

The subject of this week’s world-famous news haiku competition™ is “How to AI-Proof Your Job.” And I believe that you, yes, you, dear reader! — can craft an incredible haiku on the subject. Send me your entry — to our spiffy new email address, haiku at cheddar dot com — by noon ET Thursday for consideration by your Cheddar peers!

News You Need2Know

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter

$VST ( ▼ 0.28% ) $META ( ▲ 0.71% ) $OKLO ( ▲ 3.02% ) $BLDR ( ▲ 2.29% ) $LEN ( ▲ 0.71% ) $PHM ( ▲ 0.28% ) $DHI ( ▲ 0.24% ) $GM ( ▼ 2.04% ) $WDFC ( ▼ 1.91% ) $RYLD ( ▲ 0.06% ) $NVDA ( ▼ 5.28% ) $UBER ( ▲ 4.01% ) $DASH ( ▲ 4.34% ) $SHCO ( ▼ 0.06% ) $AMZN ( ▼ 1.38% ) $MSFT ( ▲ 0.29% )

How to AI-proof your job

The rise of agentic AI tools has triggered a seismic shift in the workplace: Even once-specialist skills like those of programmers and data scientists have become more accessible to the masses. This year, it might even be time to spare a bit of empathy for tech coders, who could find themselves staring into the abyss of obsolescence, or so it seems.

But fear not! As Harvard economist David Deming showed in a 2017 study, social skills are now the reigning champions of career success, reports John “Let It” Burn-Murdoch in the Financial Times.

So what’s the secret to AI-proofing your job? It’s about doubling down on the human advantage. It turns out the crown jewel of your career has probably always been your broader skillset: Creativity, communication, and teamwork. Unless, of course, you’re no good at those things. In which case, er…sorry.

As Deming notes, the modern economy rewards “team players, problem solvers, good communicators, and creative thinkers,” not just technical experts. It’s good news for me because I’ve been winging it on charm since I was a nipper. Say, did anyone else see “Marty Supreme” at the movies and feel like their whole approach to life so far had been validated (and I’m not just talking about that Central Park scene)?

If AI automates your technical skills, reframe the narrative (or ask ChatGPT to do it for you): The fun part of the job was never the technical parts — it’s what your technical expertise enabled you to do. Keep being the ideas person, building solutions, and collaborating on bold projects. That’s a future AI can’t touch, Mr. Burn-Murdoch writes.

Markets rise on mixed jobs data, some of which the president posted early on social media

Donald Trump has once again stirred up economic drama, but this time he may have caught global markets snoozing. Twelve hours before the official 8:30 a.m. ET release of December’s highly influential U.S. jobs report on Friday, Trump posted key figures on Truth Social, revealing job growth numbers that traders typically wait to extract from the Bureau of Labor Statistics report:

The data — showing a private-sector boost of 654,000 jobs over the last year — constituted critical insight into the U.S. economy’s 2025 performance. Yet, according to Wall Street insiders, the leak fell on deaf ears. “No one seemed to notice the post on Thursday evening,” one macro hedge fund portfolio manager told the Financial Times, frustrated by Trump’s flood of Truth Social posts diluting their impact.

For traders, timing is everything, and the Thursday night leak — shared after U.S. market hours — made capitalizing on the early reveal nearly impossible. Even so, frustrations ran high, with one investor lamenting that the slip “undermined the predictability of data releases,” forcing them to begrudgingly reconsider signing up for a Truth Social account.

University of Michigan professor Justin Wolfers didn’t mince words, calling the disclosure “unprecedented” and telling the FT, “No serious country does this.”

LOL.

When the markets did open, Wall Street rallied toward record highs. Despite the U.S. Labor Department showing fewer-than-expected December job hires, the improved unemployment rate has traders optimistic that the economy will avoid a recession.

Power company Vistra $VST ( ▼ 0.28% ) helped charge the market, leaping 11.7% after signing a 20-year energy deal with Meta Platforms to power its AI infrastructure (see our story below). A similar announcement from Oklo $OKLO ( ▲ 3.02% ) boosted its shares by 8.3%. Additionally, homebuilding stocks rallied following Donald Trump’s call to buy $200 billion in mortgage bonds to reduce rates. Builders FirstSource $BLDR ( ▲ 2.29% ) surged 11.8%, with homebuilders Lennar $LEN ( ▲ 0.71% ) (+7.9%), PulteGroup $PHM ( ▲ 0.28% ) (+7.2%), and D.R. Horton $DHI ( ▲ 0.24% ) (+6.7%) following suit.

General Motors $GM ( ▼ 2.04% ) , however, sputtered and dropped 2.7% after announcing a hefty $6 billion charge stemming from reduced EV demand, while WD-40 $WDFC ( ▼ 1.91% ) tumbled 5.5% on weaker-than-expected quarterly profits.

Meanwhile, traders are scaling back expectations of a near-term interest rate cut, as inflation remains above the Fed's 2% target. Still, hope for a strong economy and future rate cuts is lifting consumer confidence and smaller stocks, exemplified by the Russell 2000’s 4.5% $RYLD ( ▲ 0.06% ) weekly jump, outperforming the broader S&P 500.

Song of the Day: Bruno Mars, ‘I just might’

New from Bruno Mars, this song features exactly what you’d expect from the maestro, plus some fantastic outfits. Just like this newsletter!

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

*This counts as journalism, right?

ADVERTISEMENT

Keebeck Wealth Management: A modern advisory firm built for founders and families.

We offer a thoughtful, relationship-driven approach designed to bring clarity and confidence to complex financial decisions. Our team focuses on understanding each client’s goals, creating comprehensive plans, and providing transparent guidance every step of the way.

At Keebeck, we believe effective advice comes from alignment, communication, and disciplined thinking. We use technology and a collaborative process to help clients stay informed and prepared as their needs evolve.

Our mission is simple: to empower you with the insight and structure needed to navigate your financial future with purpose.

Keebeck Wealth Management — Helping you become the CEO of your capital.

* Information provided is general in nature and does not constitute personalized investment advice. A professional adviser should be consulted before implementing any of the options presented. Any tax and estate planning information provided is general in nature and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. The use of generative AI (artificial intelligence) will allow users to ask general questions, not provided by a human. This service will rely on third-party sources of data and information. We cannot guarantee the accuracy of such information, and the user should take steps to verify information provided herein. Information provided on or through this service is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Hyperlinks on this website are provided as a convenience and we disclaim any responsibility for information, services or products found on pages linked hereto. Our annual fee for portfolio management services is equal a percentage of the market value of your assets under our management. You will be charged, separate from and in addition to your management fee, any applicable Platform Fees as well as applicable independent manager fees. We do not receive any portion of the fees paid directly to third party service providers, including the independent managers.

END OF ADVERTISEMENT

Meta unveils nuclear-power plan to fuel its Brazilian jujitsu AI ambitions

Lol this guy.

Meta Platforms $META ( ▲ 0.71% ) is going nuclear, literally. The tech giant announced sweeping plans on Friday to power its AI data centers with nuclear energy, signing landmark agreements with Terraform Power $TERP ( ▼ 7.02% ) , Oklo $OKLO ( ▲ 3.02% ) , and Vistra $VST ( ▼ 0.28% ) .

The deals position Meta as an anchor customer for both new and existing nuclear facilities, addressing its enormous electricity demand as AI computing ramps up to unprecedented levels.

“We’re very eyes-wide-open that the schedule is challenging, but we think it’s important to be bold,” said Urvi Parekh, Meta’s director of global energy, talking to the Wall Street Journal. Meta’s collaboration with TerraPower — backed by Bill “Isotope” Gates — seeks new reactors generating 690 megawatts by 2032, with more to follow. Meanwhile, Oklo will develop a nuclear campus in Ohio, and Meta’s funding will secure nuclear fuel and advance the project, potentially expanding the capacity to 1,200 megawatts. “This is a major step in moving advanced nuclear forward,” said Jacob “Brevity Is the Soul Of“ DeWitte, Oklo’s CEO.

Vistra will provide immediate nuclear power from its Ohio and Pennsylvania facilities under a 20-year agreement, enhancing capacity by 433 megawatts. Vistra CEO Jim “Jim” Burke called Meta’s financial support a catalyst for federal licensing extensions and upgrades.

With solid commercial orders rolling in, TerraPower CEO Chris “Just for the Heck of It” Levesque described the collaboration as “an order for real work to begin a megaproject.” Meta joins other tech giants including Amazon $AMZN ( ▼ 1.38% ) and Microsoft $MSFT ( ▲ 0.29% ) in backing nuclear energy.

Just order the ketchup, you don't need to order everything else.

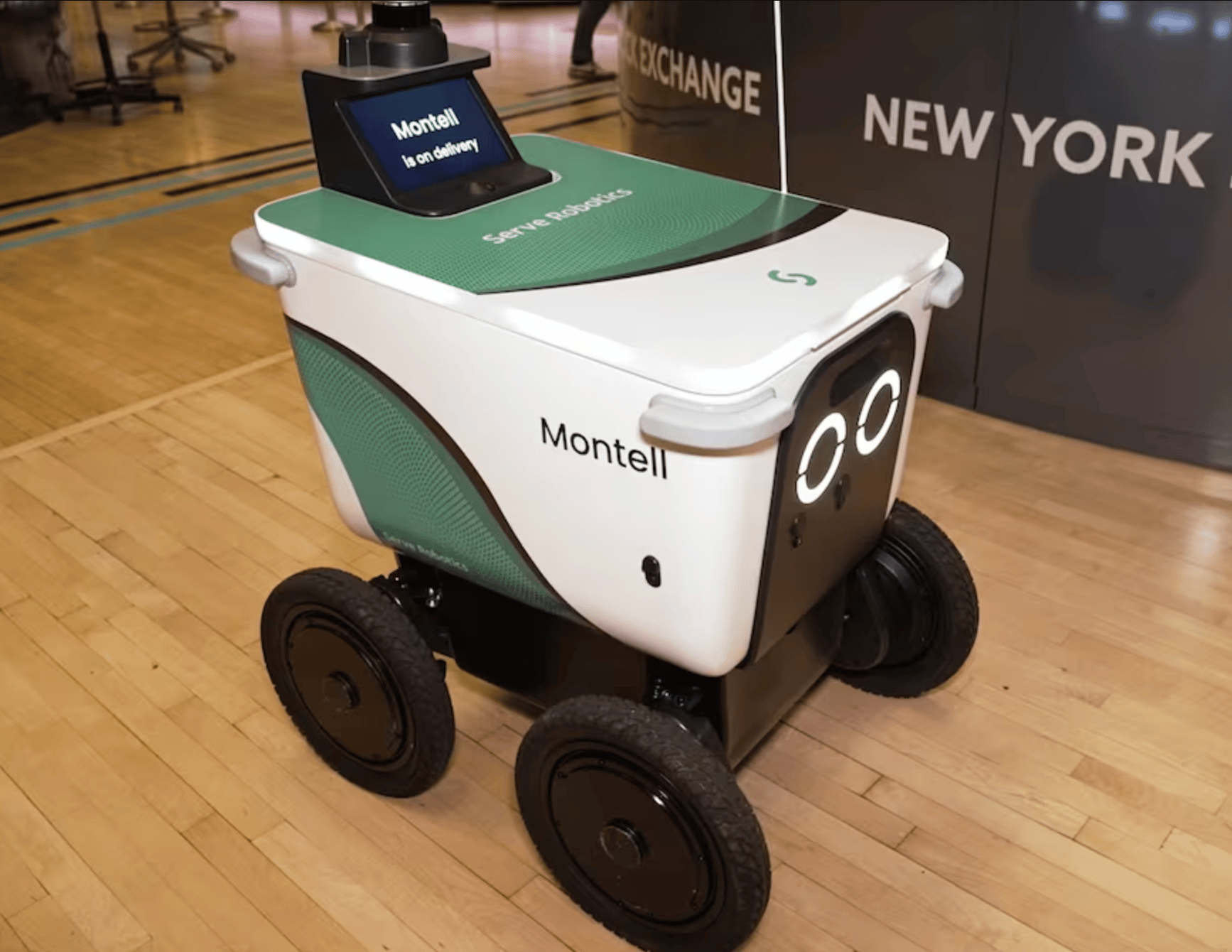

Meet Montell, a food delivery robot!

Serve Robotics, led by CEO Ali Kashani, is revolutionizing last-mile delivery with its autonomous sidewalk robots (pictured with us at the New York Stock Exchange, above!). Kashani introduced us to one of the company's 2,000 robots, named "Montell," noting, "he's one of our 2,000 robots now that are out there on the streets delivering food."

The core mission is sustainability and efficiency. The robots are "basically an autonomous delivery robot," Kashani explains, and their purpose is to "really get rid of cars on the street that are delivering, you know, two-pound burritos in two-ton cars. Doesn't make any sense. It's unsafe... These robots are here to reduce our dependence on cars, basically."

The technology is advanced, akin to a smaller self-driving car, featuring a LiDAR sensor, all-around cameras, powerful batteries, and Nvidia chips inside, $NVDA ( ▼ 5.28% ) to "understand the world and decide where to go."

Serve Robotics partners with the two largest platforms, Uber Eats $UBER ( ▲ 4.01% ) and DoorDash $DASH ( ▲ 4.34% ) , and operates in Los Angeles, Miami, Dallas, Chicago, Atlanta, and Alexandria, Virginia.

Hot food is the number one application, and the robots can handle six large pizzas or two large grocery bags. Kashani highlighted the economic benefit: "We bring that cost of delivery, which is about $10... to a dollar with the robot." This efficiency means customers can "just order the ketchup, you don't need to order everything else."

I will always tip my instacart driver heavily because I believe in stimulating the gig economy. But sure. I’d give Montell a spin occasionally because his eyes are cute like Wall-E’s. What do you think? Let us know in today’s poll below.

Should you check your 401(k) today?

👍️

Yep!

Soho House’s $2.7B deal to go private hits a snag

Soho House’s bid to go private has hit an unexpected roadblock after MCR Hotels, a lead investor in the $2.7 billion deal, announced its awkward inability to fulfill a $200 million equity commitment.

The setback, disclosed in a Thursday securities filing, took both the investment community and Soho House insiders by surprise. Shares of Soho House $SHCO ( ▼ 0.06% ) tumbled 17% intraday before recovering slightly, closing down 9.6% at $8.11. As of mid-afternoon on Friday, the stock was trading around $7.88–$8.01, a slight decline on the day following a double-digit plunge the day before.

The proposed deal, championed by Soho House’s controlling shareholder Ron “Hurkle” Burkle and backed by Apollo Global Management and Goldman Sachs Asset Management, still faces shareholder approval. However, uncertainty looms. In response, Goldman Sachs may roll over a larger share of its investment to help fill the gap. Additionally, Soho House’s team is exploring interest from other potential investors.

Soho House, known for its celebrity clientele and creative atmosphere, has improved financial performance recently but still seeks refuge from the volatility of public markets. A source close to the deal noted, “[Going private] frees them from quarterly earnings pressures and allows for strategic long-term growth.”

The last time I was in there I saw Richard Curtis, the writer of “Four Weddings and a Funeral,” “Bridget Jones’s Diary,” “Notting Hill,” and “Love Actually” in the elevator. But the club’s policy prohibits me from telling you that, so please pretend I didn’t say it. TELL THEM IT’S CAROL SINGERS.

Poll of the day: Robots or people?

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |

Need2Know is covered by Cheddar’s Terms of Service