- Need2Know, by Cheddar

- Posts

- Mickey Mouse passes the baton to a new CEO

Mickey Mouse passes the baton to a new CEO

Plus: The S&P 500 fell 1.3% for one of its sharpest drops so far this year

Happy Wednesday, !

This week’s world-famous news haiku competition™ is about how Waymo is under federal investigation after a driverless car hit a child near a school (and thankfully the child survived). It’s a heavy topic, but I believe that you, yes, you, , can craft a worthy haiku on the subject that will bring moral and spiritual clarity to the moment, just as you do each and every week. So: Send me your entry — to our spiffy new email address, haiku at cheddar dot com — by noon ET Thursday, for consideration by your Cheddar peers!

And now for something completely different.

Matt Davis — Need2Know Chedditor

News You Need2Know

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter

$DIS ( ▲ 2.84% ) $PEP ( ▲ 2.01% ) $KO ( ▲ 0.72% ) $NVDA ( ▼ 3.18% ) $MSFT ( ▲ 0.69% )$PLTR ( ▼ 11.72% ) $PEP ( ▲ 2.01% ) $DVA ( ▲ 6.14% ) $PYPL ( ▼ 1.79% )

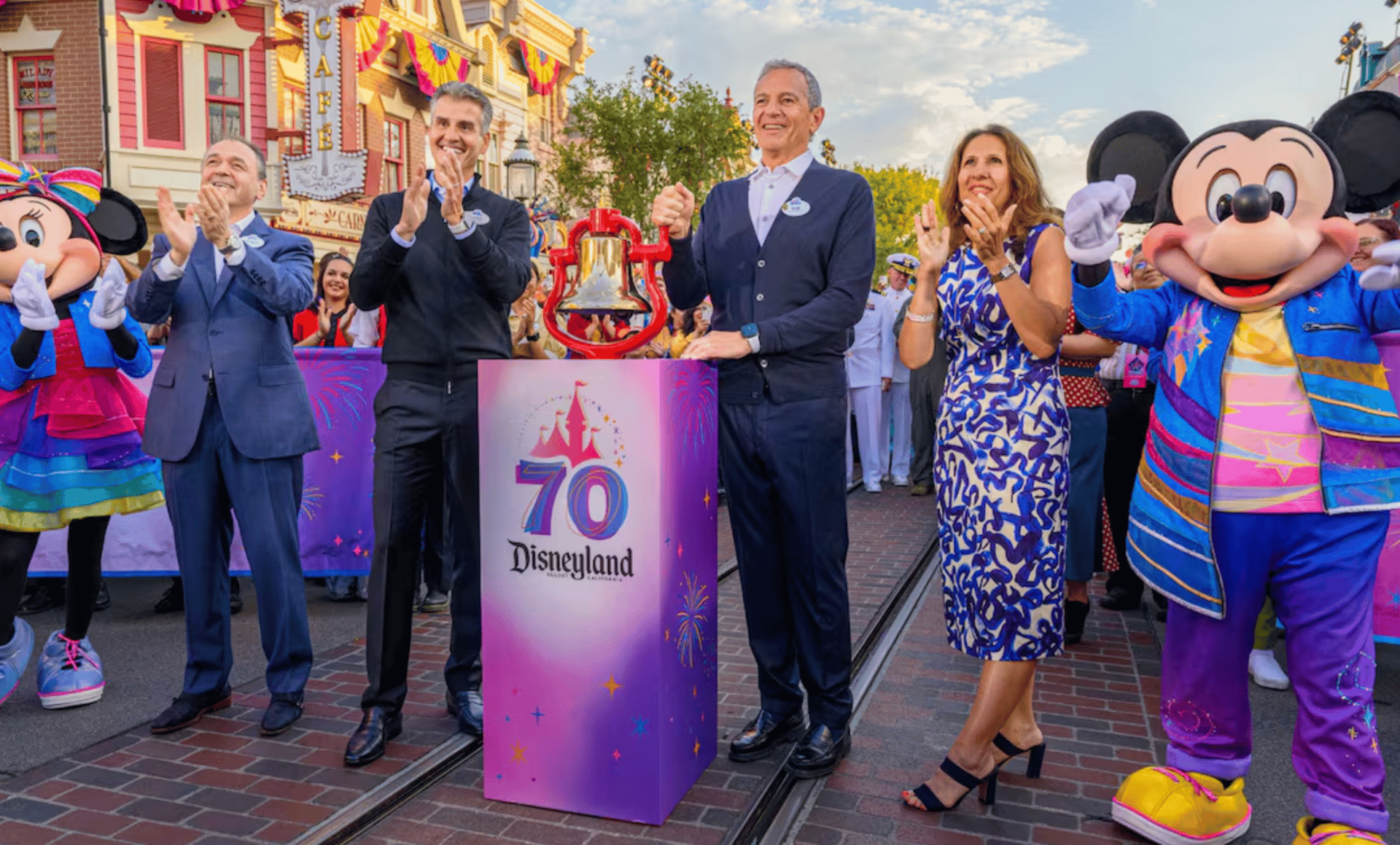

Mickey Mouse passes the baton to a new CEO

New Disney CEO Josh D’Amaro (left, next to the podium) and Disney’s outgoing CEO Bob Iger (right, next to the podium).

Disney $DIS ( ▲ 2.84% ) is ushering in a new era of leadership with Josh D’Amaro, the current head of Disney Parks, assuming the role of CEO next month. I’m not sure if you remember this, but the character of Tom Wambsgans in the TV show “Succession” also ran the parks department before, you know…SPOILER ALERT…ascending to the top job.

The transition will follow Bob Iger’s departure on March 18, marking the end of his storied tenure. Dude left the top job once already, then came back and replaced his replacement. Cold. Investors will be hoping the second time’s a charm. D’Amaro’s compensation package reflects his key role in guiding Disney’s future — a whopping $38 million, according to SEC filings. I mean, he’s no Elon Musk.

D’Amaro is set to earn a base annual salary of $2.5 million, complemented by a $9.75-million one-time bonus. Perhaps his most significant perk is an annual long-term stock incentive of $26.2 million, along with a bonus of 250% of his base salary, contingent on hitting performance goals. Known for his hands-on leadership style, D’Amaro is celebrated among Disney staff for his deep connection to the company’s culture. Reports suggest he’s a “forward-facing executive who spends time in parks [and] talks directly with employees.”

Although, you know, I imagine he probably wrote those reports. Dana Walden, the runner-up for the CEO position, will assume a newly created role as President and Chief Creative Officer, earning $24 million annually. Walden is praised for her deep credibility among Hollywood talent and for stabilizing Disney’s entertainment business during challenging times. Her contract runs through March 17, 2030. My guess is she’ll be CEO by then if Josh taps out. The firm’s shares were down about 1% on the news.

Markets suffer their biggest fall in a while

Wall Street experienced turbulence Tuesday as Big Tech stocks dragged markets lower. New worries about the threat posed by new AI tools to software companies sparked the slump. Meanwhile gold and silver rebounded after recent sell-offs. The S&P 500 $SPX ( ▼ 0.2% ) fell 1.1%, the Nasdaq $NDAQ ( ▲ 0.75% ) slumped 1.9%. Nvidia $NVDA ( ▼ 3.18% ) dropped 3.2%, and Microsoft $MSFT ( ▲ 0.69% ) fell 3.9%, as worries lingered over their prolonged dominance and high valuations.

Gold surged 6.1% to $4,935 per ounce, and silver climbed 8.2%, marking a rebound after sharp declines last week. This comes after gold’s price nearly doubled in the past 12 months before a steep fall last week.

Select companies had standout performances. Palantir Technologies $PLTR ( ▼ 11.72% ) rose 6.2% after surpassing profit expectations and forecasting 61% revenue growth. PepsiCo $PEP ( ▲ 2.01% ) gained 5.2%, announcing slight price cuts on snacks like Lay’s and Doritos (see the story below!) to attract inflation-weary customers. Dialysis firm DaVita $DVA ( ▲ 6.14% ) soared 20% after beating earnings estimates, while PayPal $PYPL ( ▼ 1.79% ) plunged 19.6% following weak quarterly performance. Just another day in the markets, my friends. I always say buy the dip. #NotFinancialAdvice

Musk’s big merger aims to create orbital data centers

Elon Musk: Just created a $1.25 trillion company

Elon Musk has orchestrated the largest merger ever, with his rocket company, SpaceX, acquiring his artificial intelligence startup, xAI. The deal, valued at $1.25 trillion, was confirmed Tuesday, cementing SpaceX’s valuation at $1 trillion and xAI at $250 billion. “We’re creating the most ambitious, vertically integrated innovation engine on (and off) Earth,” Musk wrote in a blog post, highlighting the merger’s focus on combining AI, rockets, space-based internet, and the X social media platform.

Central to this merger is Musk’s vision to develop “orbital data centers,” leveraging SpaceX’s expertise in satellites and reusable rockets to revolutionize infrastructure for AI. Musk’s aim is to address booming AI demand by deploying data centers in space, enhancing functionality for tools like xAI’s Grok chatbot. However, Grok has faced criticism recently for allowing users to create controversial content, including (checks notes) sexualized images of children.

Sigh.

The merger is structured as a share exchange, with each xAI share converting to 0.1433 shares of SpaceX stock. Bank valuation documents place SpaceX’s worth between $859 billion and $1.26 trillion. Observers also anticipate a highly lucrative SpaceX IPO later this year, expected to raise $50 billion at a valuation nearing $1.5 trillion.

Musk’s bold integration of AI and space technologies signals a new chapter in innovation, reflecting his ongoing ambition to push boundaries both on Earth and beyond. There’s just the slightest chance, of course, that this merger and its valuation could be over-hyped. Weigh in in today’s poll!

Song of the Day: Bruce Springsteen, ‘Streets of Minneapolis’

Bruce Springsteen has never sounded angrier than on his new song, “Streets of Minneapolis.” Springsteen, writes Spencer Kornhaber at The Atlantic, “conveys that we’re living through a time that will be sung about for years to come, and that the future depends a lot on what we do in this moment.” So, it’s a lot like this newsletter!

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

*This counts as journalism, right?

ADVERTISEMENT

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

END OF ADVERTISEMENT

Chips will be cheaper because PepsiCo misses you

Snack lovers have something to celebrate! PepsiCo $PEP ( ▲ 2.01% ) plans to cut prices on popular snacks such as Lay’s potato chips, Doritos, and Flamin’ Hot Cheetos by up to 15%, rolling out new suggested retail prices across the U.S. this week.

The move comes in response to rising consumer frustrations over soaring food prices in an inflationary economy. It makes me wonder why they didn’t do it earlier if it was something that, you know, they could absorb it into their $2.5 billion net income in the fourth quarter of 2025.

“We’ve spent the past year listening closely to consumers, and they’ve told us they’re feeling the strain,” said Rachel Ferdinando, CEO of PepsiCo US. “Lowering the suggested retail price reflects our commitment to help reduce the pressure where we can.”

Prices for salty snacks have skyrocketed in recent years, with retail prices in June 2024 soaring 38% higher than the year prior, according to Jefferies analysts. PepsiCo CEO Ramon Laguarta admitted, “It became a little more expensive than we would like it to be.” As a result, sales growth is slowing.

Under the new pricing strategy, an 8-ounce bag of Lay’s chips could drop from $4.99 to $4.29, while a 9.25-ounce bag of Doritos may fall by 80 cents to $5.49. That’s the size of Doritos pack you might share while watching a movie between, say, four or five people…or, in my case, just eat the whole thing on your own. Don’t judge me.

To emphasize the changes, PepsiCo is updating packaging to remind shoppers that the lower prices maintain the same product size. This is one of several steps PepsiCo has taken recently to stay competitive, including scrapping artificial colors and flavors and boosting its marketing efforts. Meanwhile its major competitor, Coca-Cola $KO ( ▲ 0.72% ) , has risen about 16% over the last year to trade near all times compared to PepsiCo’s 5.9% decline over the same period.

“Walmart is really five stores in one…I expect it will approach a $2 trillion market capitalization in the next few years.”

From big box to big bucks: Walmart joins the trillion-dollar club

Walmart $WMT ( ▲ 0.4% ) has shattered records by becoming the first retailer to reach a $1 trillion market valuation, cementing its position alongside tech giants like Apple $AAPL ( ▲ 3.04% ) , Nvidia $NVDA ( ▼ 3.18% ) , and Alphabet $GOOGL ( ▼ 1.89% ) . The firm’s strategy of balancing affordability with technological innovation propelled Walmart’s shares to rise 26% last year, outperforming competitors.

Walmart has leveraged cutting-edge AI technologies to improve supply chain automation, inventory forecasting, and online shopping experiences. These investments have allowed the retail giant to beat U.S. same-store sales estimates for 15 consecutive quarters. Louis Navellier, Chief Investment Officer at Navellier & Associates, told Reuters, “Walmart is really five stores in one…I expect it will approach a $2 trillion market capitalization in the next few years.”

With $1 in every $4 spent on groceries in the U.S. going to Walmart, its “every day low price” strategy has resonated deeply in an inflationary economy. As newly appointed global CEO John Furner steps into leadership, Walmart is poised to maintain its dominance.

My favorite Walmart story is how they bought in donkeys to publicize their second store when it opened in Arkansas. They also had a bunch of watermelons on a cart outside. Arkansas is a hot state, as you may know, and those watermelons all burst. Then the donkeys pooped all over the place. Smells like victory!

Should you check your 401(k) today?

👎️

No

Poll of the day: Overvalued? Or no?

Do you think there's a slight chance Elon Musk's SpaceX merger could be overvalued at $1.25 trillion? |

Poll of the day: You think the housing market is overpriced

We asked: What do you think of the U.S. housing market?

You answered:

🟩🟩🟩🟩🟩🟩 It's still ridiculously inflated and always has been and always will be. (234)

🟨🟨🟨🟨⬜️⬜️ It's definitely a buyer's market compared to a year ago. (153)

🟨⬜️⬜️⬜️⬜️⬜️ It's still a seller's market and always will be. Good luck! (40)

🟨🟨⬜️⬜️⬜️⬜️ I want to upgrade from my lean-to to a tent, but I'm waiting for interest rates to come down. (87)

514 Votes

via @beehiiv polls

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |

Need2Know is covered by Cheddar’s Terms of Service

P.S. So, you remember the cheese puns that used to open this newsletter? Suffice to say, they were divisive. Now, thanks to a thing called “dynamic content options,” I can offer you the option to see cheese puns again, if you’re one of the thousands who got in touch bemoaning their departure six months ago. All you need to do is answer “true” on this survey, and submit it. If you never want to see cheese puns in this newsletter again, don’t click that link, don’t fill out the survey, don’t submit it. Just keep reading and pretend this conversation never happened. Mmmkay? Thank you.