- Need2Know, by Cheddar

- Posts

- Nvidia hits earnings ‘grand slam,’ markets sigh with relief

Nvidia hits earnings ‘grand slam,’ markets sigh with relief

Plus: Jeff Bezos back in the spotlight with a $6.2 billion A.I. gambit.

Today’s newsletter is brought to you by:

Greetings N2K reader!

This week’s world famous News Haiku™ competition is about the last U.S. penny ever being minted (it’s true, they are no more!). Send me your entry — to our spiffy new email address, haiku at cheddar dot com — by noon today for consideration by your Cheddar peers. And now for something completely different!

—Matt Davis, Need2Know Chedditor

News You Need2Know

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter

$NVDA ( ▲ 1.02% ) $AVGO ( ▼ 0.4% ) $AMD ( ▼ 1.58% ) $TSM ( ▲ 2.82% ) $AMZN ( ▲ 2.56% ) $MSFT ( ▼ 0.31% ) $AAPL ( ▲ 1.54% ) $MSFT ( ▼ 0.31% ) $GOOG ( ▲ 3.74% ) $AMZN ( ▲ 2.56% ) $EMA.TSX ( ▲ 0.04% )

Markets sigh with relief on Nvidia ‘grand slam’ earnings

If you’ve been freaking out about an AI bubble, you can breathe a sigh of at least temporary relief. The anticipated quarterly earnings report from Nvidia has become the focal point in the ongoing conversation about whether AI is fueling a historic boom, or whether we’re on the verge of a historic bubble. It has implications far beyond Nvidia itself; it’s a litmus test for the durability of the AI craze. Last night, those implications were extremely positive.

Pressure was on because the market already expected Nvidia to deliver strong numbers, with analysts projecting earnings of $1.26 per share on revenue of $54.9 billion, a 59% increase year-over-year. In fact, Nvidia knocked it out of the park, with revenues skyrocketing 62% year-over-year to hit a jaw-dropping $57 billion — or slightly over 11 billion times the cost of a monthly paid subscription to Need2Know — while profits leapt 60% to $1.30 per share.

“Nvidia just hit a grand slam,” Sam Stovall, chief investment strategist at CFRA Research told the Wall Street Journal. “It will allow investors to breathe a sigh of relief that maybe valuations are not as overvalued as had been worried because of the ongoing growth that was just seen as well as projected.”

The results blew past Wall Street’s predictions — and so did the company’s bold forecast of $65 billion in revenue for the current quarter, which would subscribe you to a full 1 billion ad-free years of Need2Know, by which time the Canadian Rockies will have long since eroded into a flat plain. After a 10% dip over the last three weeks amid an AI-driven market cooldown, Nvidia’s stock bounced back, climbing over 6% in after-hours trading on Wednesday following the impressive earnings report.

By the time you read this, they could be up even more than that. Options traders were betting on a roughly 7% swing in Nvidia shares after the company's earnings report and through Friday.

Shares of fellow chip makers Broadcom $AVGO ( ▼ 0.4% ) and Advanced Micro Devices $AMD ( ▼ 1.58% ) gained in after-hours trading after Nvidia’s report, as did U.S.-listed shares of Taiwan Semiconductor Manufacturing $TSM ( ▲ 2.82% ) . Fellow major tech stocks Amazon $AMZN ( ▲ 2.56% ) and Microsoft $MSFT ( ▼ 0.31% ) also ticked up after the close.

The surge in AI enthusiasm began with the release of OpenAI’s ChatGPT three years ago, propelling Nvidia from a relatively niche graphics chipmaker into a central figure in the, let’s say… AI revolution. Nvidia’s chips are now indispensable for the development of generative AI, making the company a bellwether. As a result, Nvidia’s annual revenue skyrocketed from $27 billion in 2022 to a projected $208 billion this year, driving its market value to highs of $4.5 trillion and surpassing tech giants like Apple $AAPL ( ▲ 1.54% ) , Microsoft $MSFT ( ▼ 0.31% ) , and Alphabet $GOOG ( ▲ 3.74% ) .

“Saying this is the most important stock in the world is an understatement,” said Jay “Out of the” Woods, chief market strategist at Freedom Capital Markets.

However, skepticism has been growing in recent weeks, with investors questioning whether the AI boom has been overly hyped, even as big tech companies, including Alphabet and Meta $META ( ▲ 1.69% ) , continue to pour billions into AI development. Nancy “Spine“ Tengler, CEO of Laffer Tengler Investments, said, “Skepticism is the highest now than anytime over the last few years.”

Investors also tuned into the earnings call, likened to a “State of the Union” for AI.

CFO Colette “Water” Kress said that Nvidia sees hyperscalers like Meta as a major contributor to its future growth. She also said the firm doesn’t expect any revenue from China in Q4. Kress said sizable purchase orders to China didn't happen this quarter "due to geopolitical issues" and the competitive market there. She added that the company was disappointed it couldn't ship more competitive products to China, but is committed to "continued engagement" with both the U.S. and Chinese governments. In other words, it could make even more money if the China softens its stance on working with the firm.

Here are my favorite Nv-memes from last night:

Song of the day: Dominic Fike, ‘White Keys’

Dominic Fike continues to prove he’s one of the most naturally gifted artists making music today, blending alternative pop, R&B, and hip-hop into something entirely his own. That’s what reviewer Quincy said, and I agree with it!

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

*This counts as journalism, right?

ADVERTISEMENT

Most firms sell a product. We build plans and take positions. Keebeck is a modern family office for founders and families who want clarity, speed, and alignment.

We co-invest our own capital alongside clients, so the incentives stay aligned. One transparent fee. No product stacking. AI powers our research, cash-flow and tax modeling, and risk monitoring, so you get answers in real time and decisions that hold up in the real world.

Keebeck translates complex data into simple direction and stands next to you through the full life cycle of an investment, not just the pitch. Public markets. Private deals. Estate, tax, and governance. Liquidity when it matters.

We measure success in outcomes, not AUM. We show our work: every model, every assumption, every fee.

If you want spreadsheets, hire a software developer. If you want a partner with skin in the game, call Keebeck Wealth Management.

Keebeck Wealth Management Helping you become the CEO of your capital.

Jeff Bezos is running an AI startup now

Natty or not, Jeff Bezos (left) is back to running a company again (right). But I wonder if he’ll put a tie back on, and/or resume eating carbs?

Jeff Bezos is officially back in the operational spotlight with the launch of Project Prometheus, an AI startup co-founded with his physicist friend, Vik “Vaporub” Bajaj. The company boasts $6.2 billion in funding — although, you know, the majority of that came from the Jeffster. Or as our president called him in 2019, giving him a nickname that would not pass muster with my editor, “Jeff Bozo.”

It signals Bezos’ reentry into the tech race since stepping down as Amazon’s $AMZN ( ▲ 2.56% ) CEO in 2021, and places him firmly amid fierce competition in AI innovation.

Focused on developing AI technologies for physical engineering and manufacturing tasks, Project Prometheus aligns with Bezos' fascination with outer space exploration. The company targets applications in aerospace, automotive, and computer systems.

Elon Musk called Bezos a “copycat” for the move, simultaneously promising to start a company that uses the Internet to sell books, of all the crazy things.

Quote of the Day

Donate as little as $10 and win all these cool once-in-a-lifetime prizes.

Alltroo is raffling Pete Davidson’s truck, for some reason charity

Altroo, co-founded by former 12-year NFL veteran Kyle Rudolph (he made 50 receiving touchdowns, 4,773 receiving yards, and 482 receptions over 12 seasons, mostly with the Minnesota Vikings, since I know you’re curious…say, did I mention I’ve gotten super into the NFL since I paid $400 for “Red Zone” and moved to the South!?) is revolutionizing charitable fundraising by making it accessible and exciting for fans — offering "unconventional" prizes like a chance to win Pete Davidson’s truck. (“Pete Davidson’s tricked-out 1970 Chevrolet K5 Blazer has been fully restored and modernized,” the site assures us.)

Rudolph and his co-founder created a consumer platform to fill a void they saw after traditional charitable events were shut down by the pandemic. Recognizing the power of "sports music and entertainment," the platform lets fans "donate as little as $10 and win all these cool once-in-a-lifetime prizes." These experiences and prizes — which include a Porsche, Mustang, or Bronco (although not, you know…a certain former NFL star’s most famous Bronco, sadly…) — are tied to celebrity partners, making the donation process a "low lift" for the stars and leveraging their platform to reach fans.

Donors support the celebrity’s personal foundation or major national organizations. The core mission is to bring new dollars into the industry. Rudolph explains that the goal is to "truly engage die hard sports fans... that $10 would not have gone to charity if it wasn't for this platform." By tapping into this new donor base, Altroo aims to "elevate the charitable giving industry and bring new dollars that ultimately weren't going in the past."

Should you check your 401(k) today?

👍️

Ah, go on then. Maybe later, after the closing bell.

If you like this newsletter, why not forward it to a friend so they can subscribe here? If you don’t, why not forward to an enemy? Thank you!

An energy CEO confronts the AI power crisis

Would you trust this man with Florida’s power grid? Because that’s essentially what you’re doing already, without realizing it…

One of my favorite school field trips as a kid was to a coal-fired power station. They showed us a chimney where a guy had fallen to his death recently.

“By the time he was at the bottom,” the tour guide told our group of aghast 8-year olds, “we had to hose him down.”

And that’s when I decided I wanted to run a power company! Realizing my childhood ambition, Emera $EMA.TSX ( ▲ 0.04% ) CEO Scott “Bats in the” Balfour is leading a strategic overhaul of the company just as North America’s energy grid faces unprecedented challenges. Balfour highlights two key drivers: the massive load from AI data centers and the broad electrification of our lives. These demands are compounded by the increasing frequency of severe storms, making reliability and resiliency the company's top priority.

I should mention that since moving south of the Mason-Dixon line — to an area not yet served by Emera — I’ve now lived through eight power cuts in less than three months. Emera's investments to strengthen the grid are comprehensive, including vegetation management, replacing wooden poles with steel and concrete, and adding electronic circuitry for faster self-healing. They are also “undergrounding” distribution lines at the rate of about 100 miles annually in the Tampa Electric area. Hurry it up, fellas!

Balfour sees natural gas as a crucial, cost-effective, and reliable bridge away from coal, and he views nuclear energy, particularly small modular reactors, as an important part of the long-term clean energy future. To execute this vision, Emera plans a massive capital deployment of $14–$15 billion over the next five years (say, that’s twice what Jeff Bezos has invested in his new AI company!), prioritizing reliability, resiliency, and generation expansion. Best of luck to them.

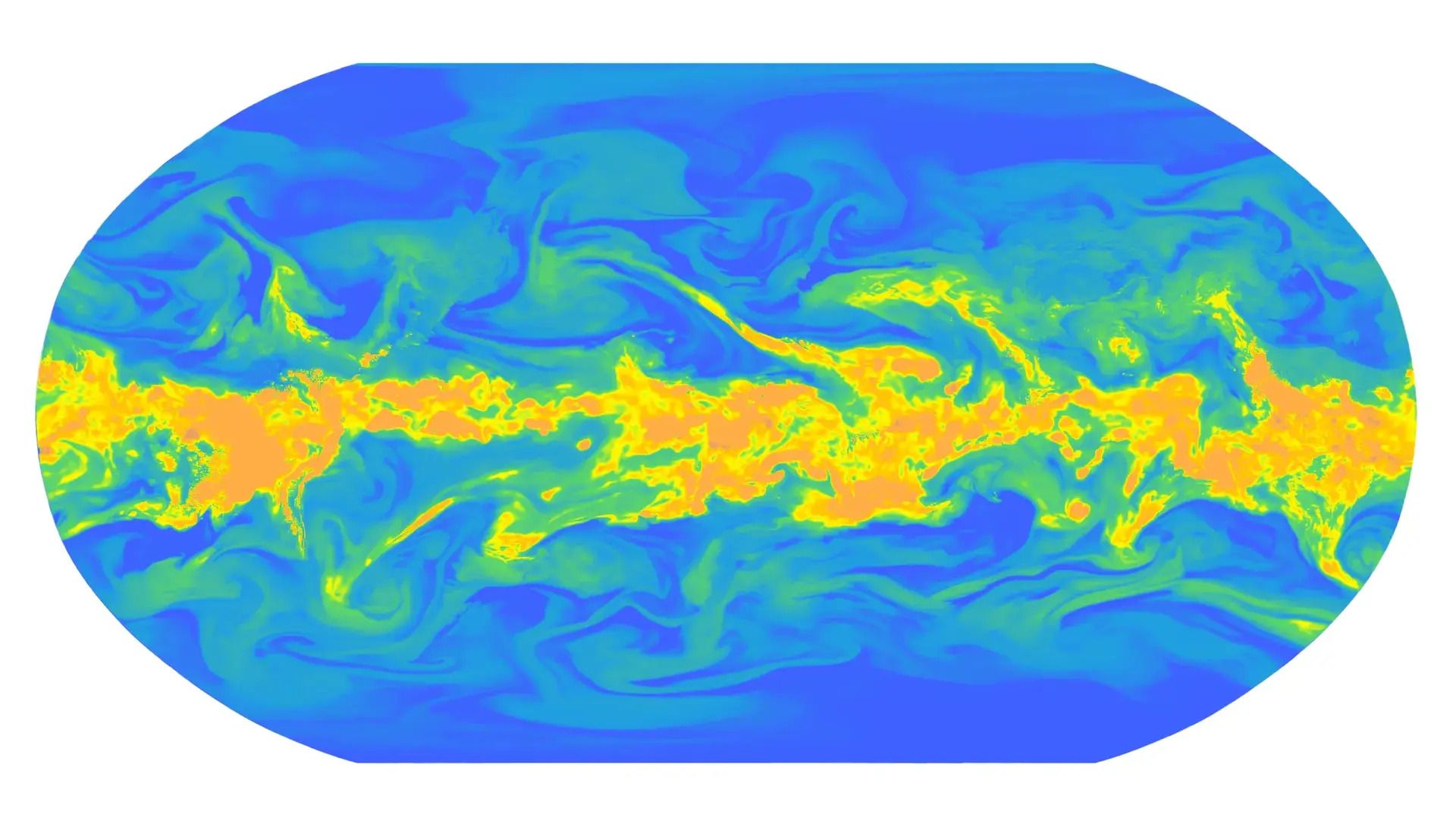

Hey Google, what’s the weather gonna be like next year?

Hot.

Google $GOOGL ( ▲ 4.01% ) has unveiled WeatherNext 2, its latest AI-powered weather forecasting model, which promises faster, more accurate predictions. Don’t they all?

Now integrated into products like Search, Maps, Gemini, and Pixel phones, WeatherNext 2 aims to provide forecasts that are both precise and highly efficient.

WeatherNext 2 generates forecasts eight times faster than previous models, predicting 99.9% of variables like temperature and wind. Powered by Google’s TPU chips, it produces reliable results within a minute — tasks that traditionally require hours on a supercomputer. The system also uses a Functional Generative Network, which efficiently incorporates randomness to generate multiple outcomes in one step. As I understand it, it’s like inviting your mother-in-law to Thanksgiving dinner.

I’d still take a light jacket with you, though, if you’re headed out. Just in case.

Poll of the day: Kim Car-dash-y-one?

Would you like to win Pete Davidson's truck? |

Poll results: Wego-nowhere

We asked: Is $199 a month for two introductory months of Ozempic enough to persuade you to try it?

You answered:

🟨⬜️⬜️⬜️⬜️⬜️ Yes. I might give it a shot, no pun intended. (52)

⬜️⬜️⬜️⬜️⬜️⬜️ Yes, but I don't need it! (31)

🟨🟨⬜️⬜️⬜️⬜️ No, it's still too expensive. (100)

🟩🟩🟩🟩🟩🟩 No. I've read about the side effects, and it could be free — I still wouldn't try it. (246)

🟨🟨🟨🟨⬜️⬜️ Oh sure, I've got a spare $200 a month with everything else being so much more expensive. Are you freaking kidding me!? At this rate I'll lose the weight regardless because I can't afford to eat! (203)

632 Votes via @beehiiv polls

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |

Need2Know is covered by Cheddar’s Terms of Service.