- Need2Know, by Cheddar

- Posts

- Silver and gold were surging. No more.

Silver and gold were surging. No more.

They're down 5%. Plus: President-linked crypto firm fires auditor after reporters ask questions.

Welcome back to a marvelous Tuesday, N2K reader!

Tomorrow I’m going to tell you what I’m excited about for the New Year, and boy, is that email going to be a doozy. Tune in! But first TODAY.

—Matt Davis, Need2Know Chedditor

P.S. This week’s world-famous news haiku competition™ is about how your AI companion is not your friend. I believe you — yes, you, dear reader! — can craft an incredible haiku on the subject. Send me your entry — to our spiffy new email address, haiku at cheddar dot com — by noon ET Thursday for consideration by your Cheddar peers!

News You Need2Know

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter

$SILVER ( 0.0% ) $GOLD ( ▲ 0.6% ) $NEM ( ▼ 2.61% ) $VGZ ( ▲ 1.88% ) $AU ( ▲ 6.15% ) $ALTS ( ▼ 5.26% ) $WLFI ( ▲ 3.15% ) $TSM ( ▲ 2.82% ) $SSNLF ( ▲ 55.02% ) $AAPL ( ▲ 1.54% ) $NVDA ( ▲ 1.02% ) $INTC ( ▼ 1.14% )

Silver and gold, once surging, slide more than 5%

Auric Goldfinger: He planned to blow up Fort Knox to send the price of gold spiking…

As geopolitical uncertainties and inflation fears continue to loom, the precious metals market is in for a potentially volatile ride, with traders forced to reevaluate their strategies under newer, stricter requirements.

Silver $SILVER ( 0.0% ) and gold $GOLD ( ▲ 0.6% ) both experienced a sharp decline on Monday after the Chicago Mercantile Exchange announced higher margin requirements for precious metals trading, asking traders to post more cash on their contracts to safeguard against potential defaults during settlements.

The adjustment follows a significant surge in both silver and gold prices this year, with silver more than doubling in value and gold futures rising 65%. The CME said that the changes are part of a “normal review of market volatility.”

Silver futures, which recently spiked to $80 per ounce — levels not seen since the 1980s— fell 8% early Monday, while gold slid 5%. The strong rally in silver had been fueled by dwindling supplies, slowed production at major mines, and rising industrial demand for applications like solar panels and data centers.

The CME’s decision also had ripple effects across mining stocks. Newmont $NEM ( ▼ 2.61% ) , the world’s largest gold mining company, saw its shares drop 6%, while smaller miners such as Vista $VGZ ( ▲ 1.88% ) and AngloGold $AU ( ▲ 6.15% ) faced even steeper declines.

Song of the Day: HAIM, ’Relationships’

HAIM are irritated “when an innocent mistake turns into 17 days,” which is apparently a “relationship” for Gen Z these days. Just like this newsletter! (Caution: They swear a bit.)

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

*This counts as journalism, right?

ADVERTISEMENT

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

Trump-linked crypto firm fires auditor after reporters ask questions

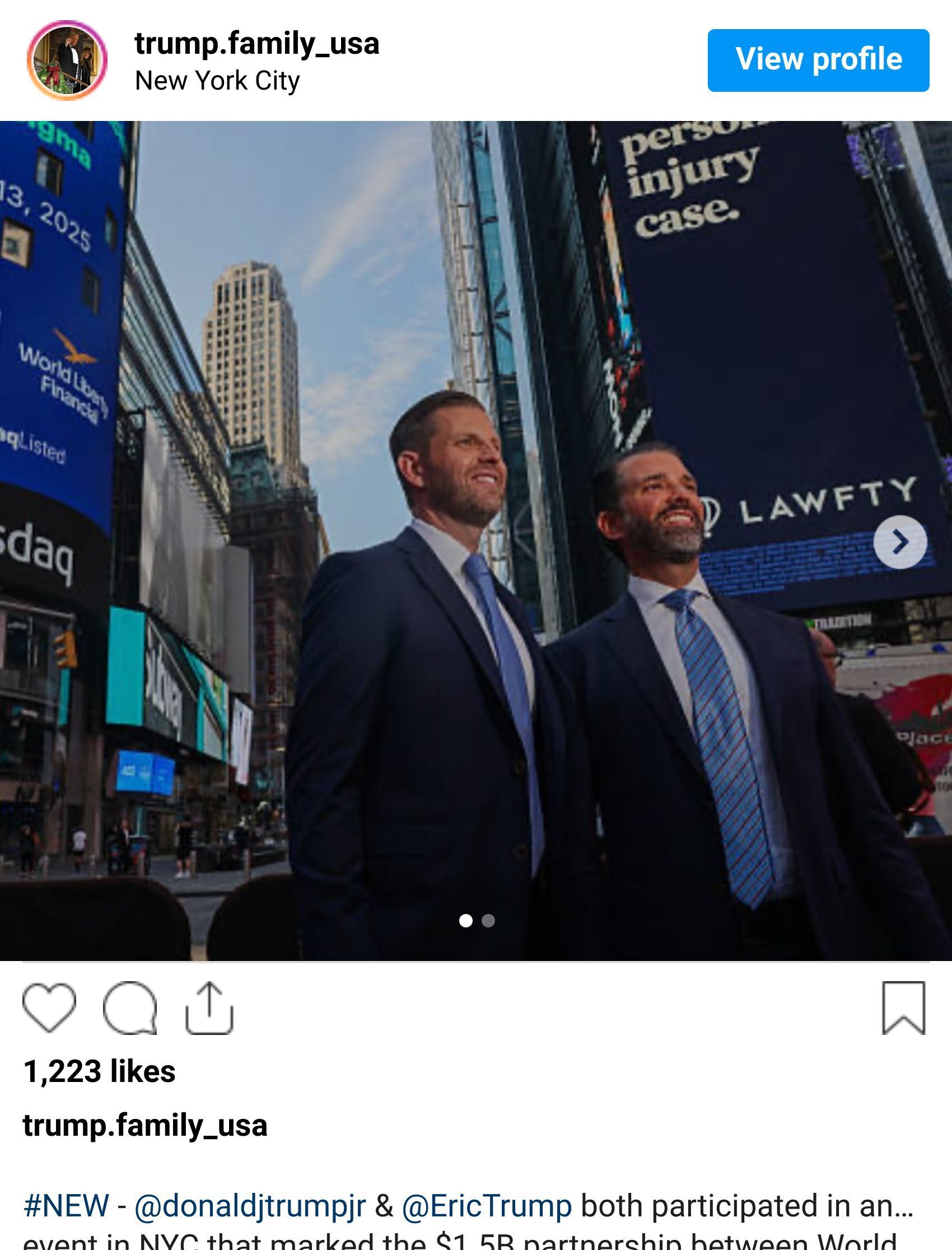

(The Instagram image above shows Donald Trump, Jr. and Eric Trump announcing the partnership between World Liberty Financial & ALT5 Sigma. Eric Trump was appointed as an ALT5 Board Director, which as you’ll read below may have been a bit of a mistake.)

Alt5 Sigma $ALTS ( ▼ 5.26% ) , a U.S.-listed cryptocurrency venture backed by the Trump family, has terminated the services of its auditor, Victor Mokuolu, following inquiries from the Financial Times regarding the firm’s operational license.

The Las Vegas–based company, which pivoted, as one does, from recycling to biotech and then to blockchain, secured a contract in August to acquire crypto tokens from the Trump family’s World Liberty Financial $WLFI ( ▲ 3.15% ) . However, Alt5 Sigma's financial disclosures have been, let’s say, problematic, failing to produce timely quarterly results and frequently changing auditors, including Mr. Mokuolu, whose license expired more than four months ago — before he was hired.

Its stock is down 75% this year, and after the Financial Times inquired, Alt5 Sigma fired Mr. Mokuolu on Christmas Day. (Merry Christmas!)

According to a regulatory filing, the company has now appointed its third auditor in just six weeks. Alt5 Sigma initially told the FT that Mr. Mokuolu was “undergoing a peer review."

The situation has created significant uncertainty around Alt5 Sigma's financial standing. The company is currently facing a potential delisting from the NASDAQ index due to non-compliance with filing requirements and has been beset by significant internal changes, including the departure of its CFO Jonathan “I’m Outta Here” Hugh and CEO Peter “Me Too, But Not in That Way, You Know?” Tassiopoulos.

In addition to these challenges, Alt5 Sigma's Canadian subsidiary and a former principal are appealing a Rwandan court's criminal liability ruling for [checks notes] illicit enrichment and money laundering. Both Alt5 Sigma and its former principal deny any wrongdoing and maintain they are the victims of fraud.

Quote of the Day

Rather than rely on getting more debt, we are currently selling our house.

Intel fails up again as Nvidia buys $5B stake

“Ouroboros” (2025), Marcel Duchamp Jr.

Nvidia $NVDA ( ▲ 1.02% ) has officially finalized its $5 billion investment in Intel $INTC ( ▼ 1.14% ) , acquiring over 214.7 million shares through a private placement, part of a broader strategic agreement between the two technology chipmakers that managed to get through the federal antitrust process in late December.

Attending a cocktail party this week? Don’t ask: Why would the world’s most successful chipmaker invest in the world’s least successful chipmaker?

Do say, loudly: There’s nothing fishy about any of this! Although coincidentally, the largest single shareholder in Intel is now the U.S. government, which owns 9.9% of the company since the president acquired the stake in August. Intel’s shares are up 80% since then, compared to NVIDIA’s, which are up a paltry 5.75%.

Under the deal, Nvidia, the leading designer of AI chips, purchased Intel, the leading maker of distinctive ad jingle noises (fun fact: they’re called “stings”), pricing its stock at $23.28 per share. The investment is seen as a critical financial boost for Intel, which has faced challenges in recent years, including costly production capacity expansions and a series of strategic missteps, most notably the disastrous decision to delay something called “Extreme Ultraviolet (EUV) lithography,” which caused a five-year manufacturing bottleneck and allowed competitors like TSMC $TSM ( ▲ 2.82% ) and Samsung $SSNLF ( ▲ 55.02% ) to leapfrog Intel’s transistor density. This technical stagnation was fueled by a "finance-first" leadership culture that prioritized short-term dividends and stock buybacks over the massive research and development spend required to maintain a lead, resulting in the high-profile loss of Apple $AAPL ( ▲ 1.54% ) as a customer and a total failure to compete with $NVDA ( ▲ 1.02% ) in the AI GPU market. But come on: Who among us hasn’t made exactly these common errors?

Should you check your 401(k) today?

👎

No.

Avatar and Marty Supreme scored big at the box office

Marty Supreme: It’s about ping-pong!

For actual movies that show in things called “cinemas,” or, I guess, “movie theaters,” if we’re being gauche, it’s been a very strong end-of-year push.

James Cameron’s blockbuster machine continues its reign as “Avatar: Fire and Ash” added a massive $88 million during the Christmas holiday stretch, bringing its domestic total to $217.7 million and to $760 million globally. With its predecessors holding No. 1 spots for seven consecutive weekends, Cameron seems poised for another billion-dollar triumph. The only problem, of course, is that the movie totally sucks, as the New York Times delicately tried to tell you with its ribald review:

[Cameron] is a genius of cinematic spectacle, but he doesn’t just sit back and ask you to admire his handiwork; he knows how to sweep you up…The fight sequences are models of spatial coherency and escalating tension, and they grab you wholly, turning a movie into a full-body workout…. That feeling dissipates whenever the fighting stops, the story cranks back up and somebody calls someone else “bro,” which happens too often. The writing, and especially the dialogue, can be wincingly bad, as can be the case with Cameron. The larger issue, though, is that for all their visual pow — and despite their impressive bleeding-edge technological wizardry — the movies have remarkably little staying power… Cameron’s signature mix of pulp and poetry can be transporting, but here it just gave me whiplash.

TLDR: The Avatar movies are crap.

Newcomers also made waves this weekend. A24’s “Marty Supreme,” a sports dramedy starring Timilee Chamaleth Chimilothé Timtam Timothée Chalamet, claimed the third spot with $27.1 million over the holiday frame, marking A24’s second-best debut ever. Also, two of my colleagues, both Jewish, observantly watched it on Christmas Day. Meanwhile, Disney’s “Zootopia 2” made $25.2 million over the holiday, bringing its global total to a staggering $1.42 billion — for those of us who can’t bear the idea of going to see it, it’s apparently an anti-immigration movie in which two furry CGI-cops investigate the mysterious arrival of reptiles in a city previously dominated by mammals. But you be the judge.

How to build an emergency fund, pay off debt, and LOL make a plan for your money in 2026

Oh look, it’s your finances!

As the new year begins, many are embracing financial resolutions designed to help tackle debt, build savings, or rethink their “approaches” to spending.

“New Year’s is a really good time to review and realign your financial goals overall,” said Erica Grundza, certified financial planner at Betterment, talking to the Associated Press.

So, the start of 2026 offers a fresh opportunity to reflect and set realistic financial goals that align with your long-term vision. For some, like Rachel Pelovitz, this year means tough decisions. After a job loss and mounting debt, Pelovitz and her husband chose to sell their house. “Rather than rely on getting more debt, we are currently selling our house,” Pelovitz told the AP, adding that her main objective is to pay off half of her credit card debt by year’s end. Oof.

Others, like Jenni Lee, are focusing on tightening budgets and saving for future milestones. “I’m now in my late 20s… I’m starting to really think about where I pinch now so it won’t hurt later when I finally decide to purchase and own a place,” said Lee.

Whether it’s building an emergency fund or finding a balance between enjoying life and saving, the new year presents another chance — one you’ll probably squander, because who has the financial freedom, let alone confidence, to do anything but eke out a paycheck and survive till the morrow? — to take control, stay consistent, and make meaningful progress toward financial security. #NotFinancialAdvice

Poll of the day: Nvidia and Intel, sitting in a tree.

What do you think of Nvidia taking a $5B stake in Intel? |

Poll of the day: Well, it’s between two options

We asked: Is your AI companion your friend?

You answered:

🟩🟩🟩🟩🟩🟩 No. (336)

⬜️⬜️⬜️⬜️⬜️⬜️ I rely on ChatGPT for social interaction and I rather enjoy it, thank you. (20)

🟨🟨🟨⬜️⬜️⬜️ No. (188)

544 Votes via @beehiiv polls

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |

Need2Know is covered by Cheddar’s Terms of Service