- Need2Know, by Cheddar

- Posts

- Softbank exits Nvidia but insists the stock is still good

Softbank exits Nvidia but insists the stock is still good

Plus: Trump teases 50-year mortgages...

Greetings N2K reader!

This week’s world famous News HaikuTM competition theme is that Peloton is recalling 833,000 Bike+ units after seat post failures that hurt people’s butts (and other bits). Send me your entry — to our spiffy new email address, haiku at cheddar dot com — by noon ET on Thursday for consideration by your Cheddar peers. Now for something completely different.

—Matt Davis, Need2Know Chedditor

News You Need2Know

If you like this newsletter, why not forward it to a friend so they can subscribe here? If you don’t, why not forward to an enemy? Thank you!

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter

$SFTBY ( ▼ 3.14% ) $NVDA ( ▲ 1.02% ) $PLTR ( ▲ 0.26% ) $ABB ( ▲ 1.06% ) $MORN ( ▼ 1.46% ) $PLTR ( ▲ 0.26% ) $BTC.X ( ▲ 0.95% ) $ETH.X ( ▲ 1.3% ) $AAPL ( ▲ 1.54% ) $TSLA ( ▲ 0.03% ) $NWSA ( ▲ 1.24% ) $BBERG ( 0.0% ) $TMUS ( ▲ 0.07% )

SoftBank cashes out of Nvidia

SoftBank $SFTBY ( ▼ 3.14% ) has sold its entire stake in Nvidia $NVDA ( ▲ 1.02% ) for $5.83 billion. The move aligns with the Japanese conglomerate's significant investment into OpenAI, as it channels $22.5 billion into the ChatGPT maker. Yoshimitsu Goto, SoftBank’s Chief Financial Officer, explained during an investor presentation that the sale is part of the company’s strategy for “asset monetization.”

While Nvidia shares dipped by 2% following the announcement, analysts suggest the sale reflects SoftBank’s need for liquidity rather than concerns about Nvidia or the AI market. “This should not be seen, in our view, as a cautious or negative stance on Nvidia,” said Rolf Bulk of New Street Research. SoftBank’s AI ambitions involve significant spending, including recent investments in ABB’s $ABB ( ▲ 1.06% ) robotics unit and its $500 billion Stargate project.

Dan Baker of Morningstar $MORN ( ▼ 1.46% ) emphasized that this move doesn’t represent a shift in SoftBank’s AI strategy: “[SoftBank] made a point of saying that it wasn’t any view on Nvidia...At the end of the day, they are using the money to invest in other AI-related companies,” he said.

Hedge fund investor Michael Burry of “The Big Short” fame said he was shorting Nvidia stock last week, along with that of Palantir $PLTR ( ▲ 0.26% ) , a software and services company that builds AI-based applications.

Song of the day: Liam Kazar, ‘Didn’t I”

Chicago-born, Brooklyn-based singer-songwriter Liam Kazar has drawn comparisons to Josh Ritter. He was a chef before he chose to concentrate on music, and this is certainly a tasty snack from his new album “Pilot Light.”

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

ADVERTISEMENT

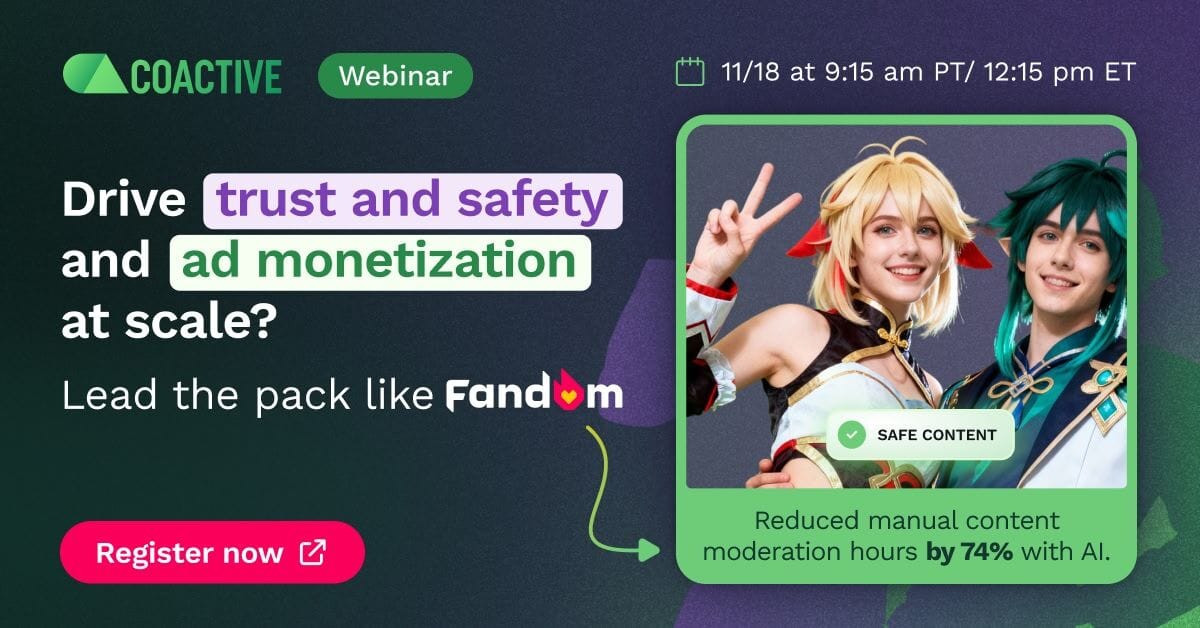

Fandom’s Winning Formula: Safer Content, 50% Savings, More Ad Revenue

The secret’s out.

Fandom—the world’s largest fan platform with 350M monthly visitors—faced a massive challenge: ensuring safety, quality, and monetization across 250,000 wikis.

Their solution? AI-powered transformation with Coactive.

Join our exclusive webinar on November 18 (9:15 am PT / 12:15 pm ET) to see how Fandom revolutionized content moderation and ad monetization.

Discover the results:

• 74% fewer manual moderation hours, boosting team morale

• 50% cost savings by automating image reviews

• Higher ad revenue from brand-safe, quality content

Learn how to turn your content into a monetizable growth engine that delights users and cuts costs.

Register today to join live or watch on demand.

*This counts as journalism, right?

Trump floats 50-year mortgage idea

Is this a solution for home affordability or a financial risk waiting to happen? Federal Housing Finance Agency Director Bill Pulte told CNN the idea is “a complete game changer,” pointing out that longer loan terms could reduce monthly payments and potentially make homeownership more accessible for millions of Americans.

While a 50-year mortgage would undoubtedly lower monthly costs — Kevin Hassett of Trump’s National Economic Council noted it could save middle-class families “a few hundred dollars a month” — many experts argue the long-term consequences outweigh the benefits. Richard Green, a professor of finance at University of Southern California, also warned CNN, “The monthly payment savings would be really small. At the same time, you’re putting people at risk because it takes a really long time for them to start paying down their loan.” Homeowners could face an 87% increase in total interest payments compared to a standard 30-year loan, for example.

Critics also worry the proposal could drive up home prices without addressing the real issue: supply shortages. Green suggested, “The best way to improve housing affordability is to build more homes where people want to live.”

Supporters like Phil Crescenzo of Nation One Mortgage counter that, despite the drawbacks, a 50-year mortgage offers a starting point for renters to enter the market: “If I had the option…I would still take that deal versus renting,” he said.

Post of the day: Woody’s back

Quote of the Day

You can't keep a CEO like Elon Musk using the same standards that you use with the rest of the corporate world.

Understanding crypto’s volatile market swings

We spoke to CoinDesk’s Andy Baehr about the rollercoaster that is the crypto markets, which have been more unstable than the actor Peter O’Toole on day four of one of his infamous drinking binges, lately. Major coins like Bitcoin $BTC.X ( ▲ 0.95% ) and Ethereum $ETH.X ( ▲ 1.3% ) have faced steep declines since October, erasing their year-to-date gains. Despite initial hopes that crypto could rival gold as a stable, long-term store of value, recent trends highlight its speculative nature. Over the past year, for example, Bitcoin demonstrated annualized volatility of 47%, while Ethereum’s volatility soared to an astounding 90%. By comparison, the S&P 500 $SPX ( ▲ 0.69% ) showed a much calmer 12.6% volatility.

Baehr made a key distinction between "fast money" and "slow money." While "fast money is kind of on hold right now" due to factors like a government shutdown and lack of new catalysts, "the slow money, the M&A, the new buildings, the new projects, the stable coin growth, the tokenization growth. The real building of the new financial system is as strong as ever,” he said, sounding ever so slightly like my mate Big Andy when he explains why he’s lost all his money day trading but certain that the next “big win” is just around the corner.

Despite historical patterns pointing to a strong Q4 for crypto markets — "typically October is an uptober" — Baehr described the current period as "definitely a sober uptober." He also expressed concern over the government shutdown's effect on legislative support for crypto: "With the government shutdown, it's like you can hear crickets, and that's a little bit concerning...we may lose the moment."

For those viewing the market pullbacks and wondering if a "crypto winter" has returned, Baehr offered a strong reassurance. Given the "regulatory support and the amount of market structure in place right now, crypto is not going away," he said. He concluded by advising market participants that "it's a good time to hit the books and regain your conviction."

But that’s not financial advice, of course. And if you ask me, which you didn’t, I’d take an index fund over crypto any day of the week. #NotFinancialAdvice

Should you check your 401(k) today?

👍️

Yet again, yes’m.

Apple plans satellite-upgraded iPhone features

Apple $AAPL ( ▲ 1.54% ) is taking iPhone connectivity to unprecedented heights with plans for new satellite-powered capabilities. According to Bloomberg's Mark Gurman $BBERG ( 0.0% ) , these features could revolutionize how people use their devices when outside traditional cellular or Wi-Fi coverage. While current iPhones already allow texting, calling emergency services, and contacting roadside assistance via satellite, Apple reportedly has several advanced features in development.

Among the innovations being explored are a satellite API for app developers, enabling satellite connections for third-party apps, and a version of Apple Maps that works entirely without cell service or Wi-Fi. Other features include sending photos through satellite messaging and improved “natural usage,” which would allow users to connect to a satellite without needing the phone pointed at the sky.

These updates aim to improve usability in remote areas, with basic satellite functionalities offered for free, while customers could pay carriers for advanced options. I’m sure the likes of T-Mobile $TMUS ( ▲ 0.07% ) are delighted.

Inside Elon Musk’s $1 trillion payday

We chatted about Elon Musk’s whopping pay deal with the Wall Street Journal’s $NWSA ( ▲ 1.24% ) Tesla $TSLA ( ▲ 0.03% ) reporter Becky Peterson. To earn the full package, Musk “would have to grow the company to an $8.5 trillion valuation. Right now, it's around 1.5, so that's quite a bit of growth,” Peterson said. The package, which would grant him a 25% voting stake, is strategically designed for retention. “The package is structured to keep him focused on the company,” with shares vesting up to ten years out, she said.

The pay package isn't solely based on market cap. Each of the incremental $500-billion growth "tranches" is "also tied to an operational goal." To qualify, Musk must hit both the market cap goal and a business growth target, such as increasing company profits.

This arrangement is unique in the corporate world. "It's unheard of," Peterson says, explaining that the Tesla board’s position is that "you can't keep a CEO like Elon Musk using the same standards that you use with the rest of the corporate world.” Some investors view this as a corporate governance nightmare, but "in the Tesla universe, they view Elon Musk as being such a unique figure that the value of the company depends on."

Peterson also touched on the legal status of Musk's 2018 pay package, which was canceled by the Delaware Chancery Court but is now under appeal at the Delaware Supreme Court. As the story unfolds, Peterson will be watching the core EV business, noting, “Tesla still needs to sell electric vehicles to make money.”

Poll of the day: Half a century of debt

Are 50-year mortgages a good idea? |

Poll of the day: Credit where it’s due

We asked: What are you going to spend your $2,000 tariff check on?

You answered:

🟨🟨🟨⬜️⬜️⬜️ It goes right in my 401(k). (141)

🟨🟨🟨⬜️⬜️⬜️ An Uber to the airport to leave the country with the money left over from paying the Uber driver. (137)

🟩🟩🟩🟩🟩🟩 Paying down my credit card debt, as usual. (217)

⬜️⬜️⬜️⬜️⬜️⬜️ A BBL, obvs. (Translation: A Brazilian butt lift, obviously.) (15)

🟨🟨🟨⬜️⬜️⬜️ More tariffs! (126)

🟨⬜️⬜️⬜️⬜️⬜️ 1/374th of a Berkshire Hathaway share. (41)

⬜️⬜️⬜️⬜️⬜️⬜️ A crash course in haiku writing. (23) 700 Votes

via @beehiiv polls

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |

Need2Know is covered by Cheddar’s Terms of Service.