- Need2Know, by Cheddar

- Posts

- The ‘sleeper hit’ movies you missed in ‘25 and five not to miss in ’26

The ‘sleeper hit’ movies you missed in ‘25 and five not to miss in ’26

Plus: Wall Street hovers near record levels

Greetings N2K reader!

Vote for the winner of this week’s world-famous news haiku competition™ in today’s poll! And now for something totally Boxing Day…

—Matt Davis, Need2Know Chedditor

News You Need2Know

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter

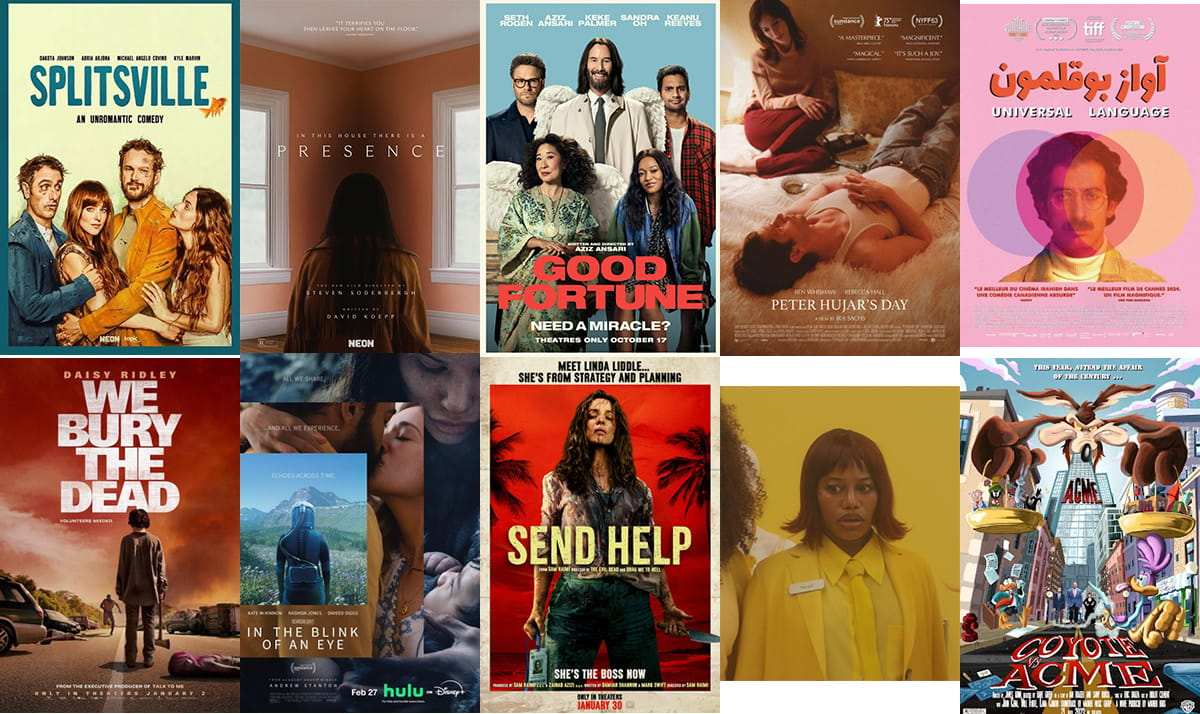

The ‘sleeper hit’ movies you missed in ‘25 and five not to miss in ’26

—This is the latest in a series of weekly guest columns on the business of movies by Grant Keller.

Everyone may be talking about the death of movie theaters, but having watched a ton of great films in ‘25 and looking at these upcoming releases on the schedule, I’m confident movie-going isn’t going anywhere, with all this great art to admire.

Here are my five that may have fallen through the cracks for you, and the five that you shouldn’t miss next year…

Song of the Day: Amber Mark, ‘Sink In’

Amber Mark’s “Sink In,” from 2024, features a hypnotic, self-produced late-night groove. It blends Jersey club beats, jazz piano, and disco influences for an immersive, dancefloor-ready experience — just like this newsletter!

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

*This counts as journalism, right?

ADVERTISEMENT

Colorado’s Most-Awarded Brewery Did Something Totally Unique

Some companies make lofty promises to investors and never deliver. Others use those dollars to unlock new levels of scale.

That’s Westbound & Down’s story. Already Colorado’s most-awarded craft brewery, they opened their doors to investors for the first time to help open a flagship Denver-metro-area location.

With 2,800% distribution growth since 2019 and a retail partnership with Whole Foods, it’s no shock investors maxed out that campaign in less than 60 days.

But it’s what comes next that’s even more exciting. Fresh off Brewery of the Year honors at the 2025 Great American Beer Festival, W&D is scaling toward 4X distribution growth by 2028.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

Wall Street hovers near record levels

Wall Street spent Christmas Eve’s shortened session in mixed but mostly positive action as major indices signaled economic resilience amid inflationary pressures and market uncertainty. The S&P 500 is up 16% this year, and even with the 2022 downturn, its Compound Annual Growth Rate since 2021 is 12.72%…

Year | President | Annual Return (Nominal) | Key Market Events |

2021 | Joe Biden | +26.89% | Post-pandemic recovery and stimulus-driven growth |

2022 | Joe Biden | -19.44% | Inflation spike and aggressive Fed interest rate hikes |

2023 | Joe Biden | +24.23% | "Magnificent Seven" tech rally and cooling inflation |

2024 | Joe Biden | +23.31% | Strong corporate earnings and "Goldilocks" economy |

2025 | Donald Trump | +16.20% | Record highs followed by volatility from new tariffs |

That’s actually better than over the last 30 years, when it’s around 10.4% in annual terms (assuming you reinvested your dividends, and were not Santa’s naughty elves). Looming recession aside or otherwise, now is always a good time to plug those numbers into the Compound Interest Calculator along with your 401(k) balance and figure out if you’ll have enough to retire on in the, hopefully, coming years. Then read up on the fact that most retirees tend to underspend in their Golden Years, and start writing a bucket list, baby!

Economic signals are mixed heading into the new year. While the U.S. economy grew 4.3% in Q3, its fastest growth in two years, struggles with rising prices and labor market uncertainty persist. Weekly unemployment claims fell to 214,000, maintaining a sign of underlying stability.

In stock-specific news this week, Dynavax Technologies $DVAX ( 0.0% ) surged 38% on Wednesday following news of a $2.2 billion acquisition by pharma giant Sanofi $SNY ( ▼ 1.31% ) . Similarly, Novo Nordisk $NVO ( ▼ 2.13% ) rallied after gaining U.S. approval for its weight-loss drug pill.

#NotFinancialAdvice

Quote of the Day

Pokemon itself as an asset class has outperformed the stock market by upwards of 3,000% in the last 20 years

How Logan Paul’s Pikachu card is breaking the collector’s market

Logan Paul is more than a collector whose brother just got his jaw broken for $93 million — he’s an alternative investment evangelist, and his prized possession is a living legend. He has “the rarest and most expensive Pokemon card in the entire world," as he told us recently, without being at all annoying about it or anything.

Paul is thrilled that the world has finally caught up to the power of collectibles as an alternative asset. “I'm personally excited that the world finally caught up,” he says, noting that this asset class is fun and has “very rich stories to tell.”

Ken Goldin, founder and CEO of auction house Goldin (you see what he did there…), is getting sorta famous from the Netflix $NFLX ( ▲ 2.17% ) show “King of Collectibles: The Goldin Touch.” He told us demand is for “really incredible unique artifacts. It’s tougher to get them out of people’s hands because people now understand this is valuable.”

Paul backed this up with powerful data: "Pokemon itself as an asset class has outperformed the stock market by upwards of 3,000% in the last 20 years,” he said. When he bought the card for $5.3 million in 2021, he recalls, "some people laughed at me, but look who's laughing now." And it’s now worth between $7 million and $12 million, which means it has indeed gone up in value more than the stock market:

Metric | Logan Paul's Pokémon Card | S&P 500 (Stock Market) |

Purchase Price (July 2021) | $5,275,000 | ~$4,350 (Index Level) |

Current Est. Value (Dec 2025) | $7,000,000 – $12,000,000 | ~$6,100 (Index Level) |

Total Appreciation | +33% to +127% | ~40% to 50% (incl. dividends) |

Annualized Return | ~6.5% to 20.4% | ~9.5% to 11% |

Goldin adds to this sentiment, noting that collectors “want to own a piece of history, something that’s cultural, something that’s iconic, and guess what? If it also appreciates in value, that’s all the better.”

My advice, which of course is #NotFinancialAdvice, is to invest your savings in a diversified portfolio of assets. If, of course, you happen to be a multimillionaire worth $150 million then you can afford to take wildly speculative bets with a fraction of your portfolio. But try to get wildly rich first because God forbid you buy a Pokemon card that, I don’t know…falls in value. Or maybe you lose it behind the couch. A brokerage account is also a lot easier to lay your hands on when you need liquidity. Just sayin’.

I will say I’m certainly not rooting for Logan Paul to lose his Pokemon card either.

Should you check your 401(k) today?

👍️

Yes. Then sing a Christmas carol and feed Tiny Tim because he’s looking a bit peaky, frankly.

How the #1 bar in the country earned its top spot

Forget everything you think you know about a "Mexican bar." In a town saturated with clichés, Superbueno in New York City’s East Village (it’s like the West Village, only cheaper and with more tattoos and generally an inverse sense of smug cultural superiority as a result, which is odd, really, because when you need a good night’s sleep the West Village is far better) just got crowned the number one best bar in the entire United States by the World’s 50 Best, and they did it by throwing out the rulebook.

Maestro de Ceremonias, Ignacio "Nacho" Jimenez, is the mastermind behind the place. He wasn't interested in a tired tequila den, but a space to showcase the complexity of his background. "Never found myself fitting in most environments," he explains, "hence always creating ways we can represent Mexican culture in a different way."

Which is presumably why he goes by the nickname “Nacho.”

That new way? It involves turning a 15-ingredient, traditional Mole into a rich, fat-washed Negroni (which I’ll admit is not exactly to my taste, by the sounds of things, but then again it takes all sorts) and taking a childhood guava drink and transforming it into the bar's deceptively minimalist, house-made "Vodka Soda." Alanis Morisette would love that drink.

This isn't about recreating Mexico City in Manhattan; it's more nuanced. Nacho saw "a very, very niche, but very small space to fill in that gap," and he's filled it with the kind of authentic, boundary-pushing hospitality that redefines what a "best bar" can be.

Check out Nacho’s story along with tales of Brooklyn Sake in the latest episode of “The Business of Booze” from Cheddar. Cheers!

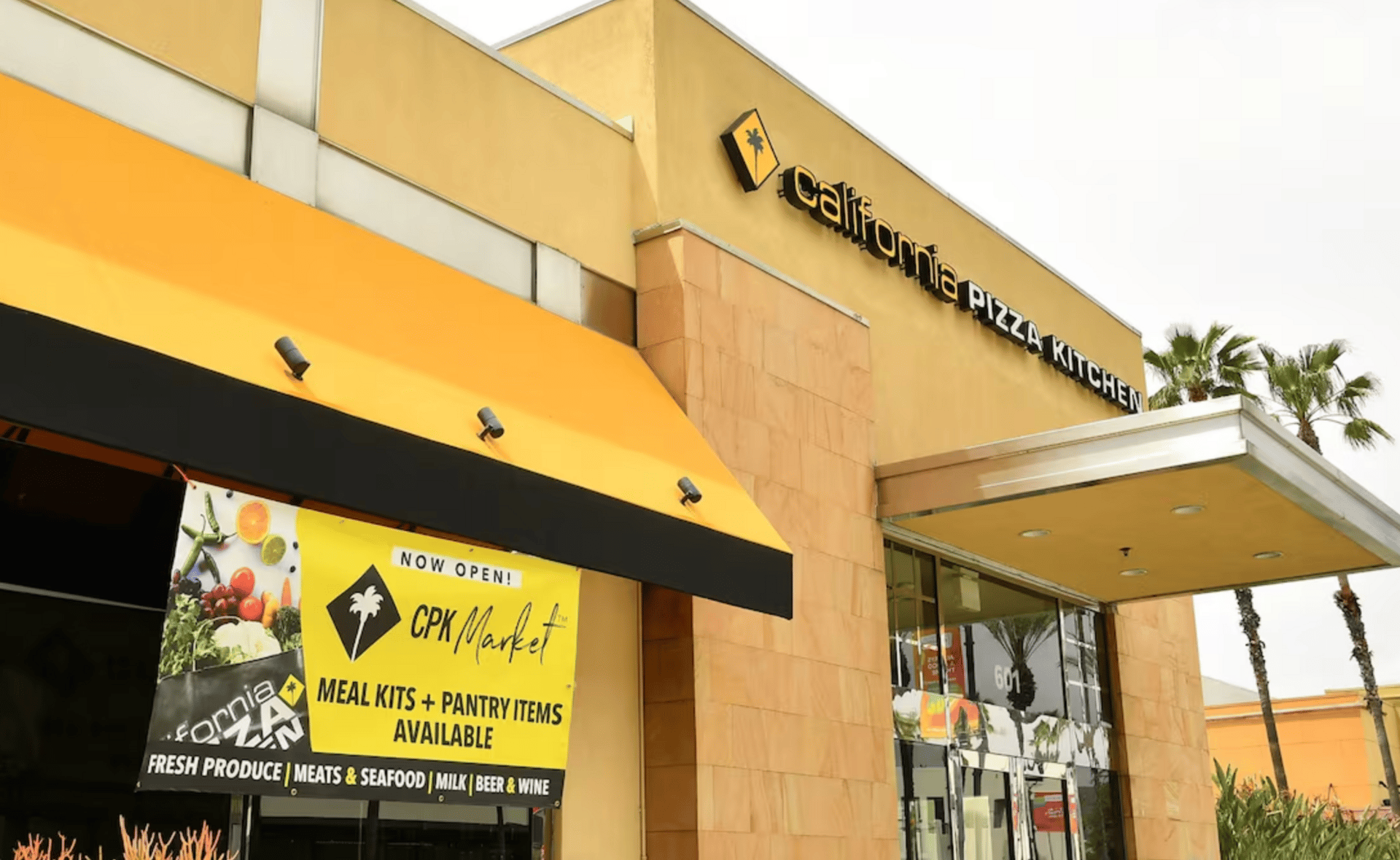

Inside California Pizza Kitchen’s big comeback

Corey Baker with private equity firm Consortium Brand Partners joined us to talk about his firm’s acquisition of California Pizza Kitchen for around $300 million. If you’re keeping track, that’s about $170 million less than what it last sold to another private equity firm for 14 years ago. In the meantime it declared bankruptcy to wipe out about $200 million in unpaid debt during the pandemic. Still, let’s hope the second time’s the charm!

Baker’s investment strategy centers on time-tested companies: "We don't invest in trends, we invest in heritage, we invested in consumer loyalty." California Pizza Kitchen, he said, "Checks those boxes. People are truly obsessed with California Pizza Kitchen."

A growth opportunity lies in franchising, Baker said, as most of CPK's 120 current locations are company-owned. Baker said: "We can triple or quadruple that footprint in a matter of years by really leaning into a franchise operation."

In the casual dining space, "I believe the new flex is quality and not growth," and consumers "will spend up for an experience," Baker told us. This commitment to premium quality extends to the firm’s take-home frozen pizza business, he insists, where California Pizza Kitchen differentiates itself by focusing on "responsible indulgence," which, while an oxymoron, sets the brand apart from competitors in the grocery aisle, Baker said. And because it’s Christmas, I wish him the very best of luck with this effort. Really. The world needs more California Pizza Kitchens like I need more Christmas sweaters. 🎅🏻

Poll of the day: Markets are up, inflation is down…

Poll results: Your favorite reindeer is…

We asked: “You're Rudolph, the red-nosed reindeer. Which of your "coworkers" is your favorite?”

You answered:

🟩🟩🟩🟩🟩🟩 Dasher, our resident efficiency expert. (104)

🟨⬜️⬜️⬜️⬜️⬜️ Dancer, who claims he was "classically trained." (34)

🟨⬜️⬜️⬜️⬜️⬜️ Prancer, an absolute diva who complains about flying over towns without "aesthetic appeal." (29)

🟨🟨🟨⬜️⬜️⬜️ Vixen, just a walking HR nightmare. (63)

🟨🟨⬜️⬜️⬜️⬜️ Comet — the guy literally doesn't know where he is. He's currently staring at a brick wall. He's been doing that since last Thursday. (37)

⬜️⬜️⬜️⬜️⬜️⬜️ Donner: The "Alpha Male" of the group. He’s started a podcast about "Primal Grazing" and refuses to eat grain because it’s "not what our ancestors intended." (13)

🟨🟨🟨⬜️⬜️⬜️ Cupid: Refuses to look at the GPS because he prefers to "follow his heart." Last year, we ended up circling a Taco Bell in Ohio for three hours because he sensed "two souls destined for a mid-tier burrito connection." (53)

🟨🟨⬜️⬜️⬜️⬜️ Blitzen: High-voltage, low IQ. (37)

370 Votes via @beehiiv polls

My favorite was Vixen, obviously.

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |

Need2Know is covered by Cheddar’s Terms of Service