- Need2Know, by Cheddar

- Posts

- Wall Street slumps as U.S. threatens tariffs on eight NATO members

Wall Street slumps as U.S. threatens tariffs on eight NATO members

Plus: Powell to attend SCOTUS argument in case challenging president's authority

Happy Wednesday, N2K reader!

This week’s world-famous news haiku competition™ is about how we can most appropriately honor Dr. Martin Luther King Jr. in America today. As we all know, MLK dedicated his life fighting for equity and justice. He taught us that even in the face of intimidation and discrimination, we must never stop working toward a better future, and I believe that you, yes, you, dear reader can craft a spectacular haiku on the subject. So: Send me your entry — to our spiffy new email address, haiku at cheddar dot com — by noon ET today for consideration by your Cheddar peers!

And now for something completely different.

Matt Davis — Need2Know Chedditor

News You Need2Know

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter

$SPX ( ▼ 0.2% ) $DJI ( ▲ 0.63% ) $NVDA ( ▼ 3.18% ) $AMZN ( ▼ 1.93% ) $NDAQ ( ▲ 0.75% ) $CL ( ▲ 1.81% ) $CPB ( ▲ 5.58% ) $ICE ( ▲ 1.03% ) $NFLX ( ▲ 0.28% ) $WBD ( ▼ 0.59% ) $PSKY ( ▼ 1.06% )

Wall Street slumps as U.S. threatens tariffs on eight NATO members

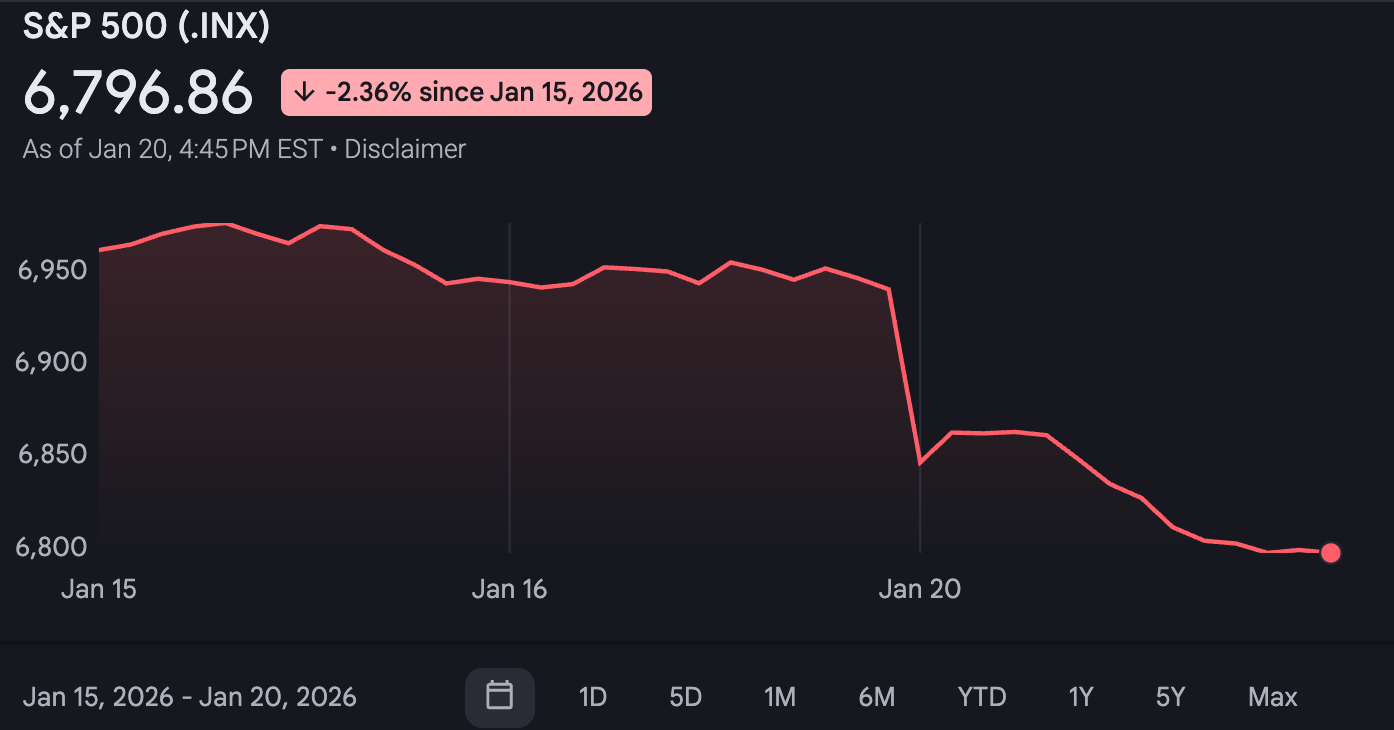

Here’s the S&P 500, courtesy of Google. That sharp drop yesterday morning is what we’re talking about!

Stock markets took a significant hit on Tuesday as geopolitical tensions flared following President Donald Trump’s threat to impose tariffs on eight NATO member countries. The tariff announcement, tied to escalating disputes over Greenland, sent shockwaves through global markets.

The S&P 500 $SPX ( ▼ 0.2% ) fell 2%, moving further from last week’s record highs, while the Dow Jones Industrial Average slid 877 points $DJI ( ▲ 0.63% ) (1.8%). Nvidia $NVDA ( ▼ 3.18% ) (-3.6%) and Amazon $AMZN ( ▼ 1.93% ) (-3.7%) led the decline in the NASDAQ $NDAQ ( ▲ 0.75% ) . Consumer staples like Colgate-Palmolive $CL ( ▲ 1.81% ) (+1.5%) and Campbell's $CPB ( ▲ 5.58% ) (+1.7%) provided some relief as investors sought safety in less volatile sectors. You still need clean teeth and soup in a nuclear bunker under the White House. You know?

Wedbush Securities analyst Dan Ives believes the market reaction, while severe, may be temporary. “Our view is just like over the last year the bark will be worse than the bite on this issue,” Ives wrote, referring to the likelihood of eventual compromise between the U.S. and EU leaders. In other words? He thinks this could be time for another “TACO Trade.”

Gold prices soared 3.7%, hitting record highs, as investors moved to safe-haven assets amidst the turmoil.

Powell to attend SCOTUS argument in case challenging president’s authority

Treasury Secretary Scott Bessent voiced concerns over Federal Reserve Chair Jerome Powell’s decision to attend a Supreme Court hearing regarding Fed independence, calling the move a “real mistake” yesterday. The hearing centers on the case of Lisa D. Cook, a Fed governor whom former President Trump attempted to dismiss. Powell’s attendance, Bessent argued, risks politicizing the central bank. “If you’re trying not to politicize the Fed, for the Fed chair to be sitting there trying to put his thumb on the scale is a real mistake,” Mr. Bessent told CNBC during the World Economic Forum in Davos.

While Bessent criticized Powell’s presence, he himself attended Supreme Court arguments last November on Trump’s use of a 1977 emergency law to impose tariffs. Bessent notably took a front-row seat alongside Commerce Secretary Howard Lutnick and trade representative Jamieson Greer, telling Fox News he wanted “a ringside seat.”

Both Powell and Bessent cited the importance of key rulings, with Bessent warning that overturning tariffs could disrupt billions in revenue. Powell’s attendance also follows tensions with the Justice Department after subpoenas related to a controversial Fed renovation.

Song of the Day: Tyler Ballgame, ‘Matter of Taste’

Tyler Ballgame’s incredible voice is drawing all kinds of comparisons (he reminds me of John Lennon in the early 1980s). His debut album “For The First Time, Again” will be released on January 30 via Rough Trade, and this is the latest preview. “Matter Of Taste” is a “fulsome, refulgent piece of songwriting, drawing on Americana and bubblegum pop in equal measure,” writes our friends at Clash. It’s held together by Tyler’s terrific sense of vocal delivery, and the emotional impact his work can gather —just like this newsletter!

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

*This counts as journalism, right?

ADVERTISEMENT

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

END OF ADVERTISEMENT

NYSE owner developing 24/7 platform to trade tokenized assets

The New York Stock Exchange, owned by Intercontinental Exchange Inc. $ICE ( ▲ 1.03% ) (ICE, but, you know, not that “ICE”), is taking a bold step into the future of trading by developing a blockchain-based platform for trading tokenized stocks and exchange-traded funds around the clock. The cutting-edge venue, expected to launch later this year pending regulatory approval, represents a significant shift in how modern markets could operate.

“This reflects an evolution of NYSE’s trading capabilities, which went from trading floor, to electronic order-book, to blockchain,” said Michael Blaugrund, ICE’s vice president of strategic initiatives. The move, he noted, would open new doors for retail investors, allowing trades to be conducted and settled instantly — even outside traditional market hours.

The NYSE’s new platform will leverage private blockchain networks to settle trades in real time, eliminating the current lag of one business day. Blaugrund explained, “It allows for new types of investor accessibility” and aligns with the growing demand for round-the-clock functionality.

It’s a lot like real-time sports betting. Or it’s like, if, say, for total example, markets took a 2% tumble after some, say, geopolitical developments, you could trade on the news on Sunday without waiting for the Federal Holiday on Monday. For instance.

Tokenized securities — digital representations of assets on a blockchain — could revolutionize finance by offering fractional ownership, deepening market liquidity, and allowing trades at any time. The New York Stock Exchange’s main rival, Nasdaq, is also pursuing similar initiatives.

“This is just the first step in a broader re-platforming, in a longer journey for ICE and the industry,” Blaugrund said.

Our revised all-cash agreement will enable an expedited timeline to a stockholder vote and provide greater financial certainty.

Netflix shifts to all-cash bid for Warner Bros.

Netflix $NFLX ( ▲ 0.28% ) has intensified its bid to acquire Warner Bros. Discovery’s $WBD ( ▼ 0.59% ) studio and streaming assets by switching to an all-cash offer at $27.75 per share, totaling $82.7 billion, with unanimous backing from WB’s board of directors. The move is aimed at outpacing Paramount Skydance’s $PSKY ( ▼ 1.06% ) rival offer and accelerating a shareholder vote, expected by April.

“Our revised all-cash agreement will enable an expedited timeline to a stockholder vote and provide greater financial certainty,” Netflix co-CEO Ted Sarandos said. Shares of Netflix gained 0.9% following the announcement, while Paramount and Warner Bros. saw slight declines in early trading.

Paramount Skydance previously offered $30 per share but faced criticism for uncertainties surrounding its bid, which Warner Bros. cited as insufficient compared to Netflix’s strategy. As regulatory scrutiny looms, Netflix’s investment-grade credit rating and lower leverage ratios bolster its pitch, making the deal more viable while Warner Bros. shareholders weigh long-term impacts and competing offers.

Should you check your 401(k) today?

👎️

Under no circumstances.

Trump to tout housing affordability plan in Davos

President Donald Trump has arrived in in Davos, Switzerland, for the World Economic Forum, a gathering of global billionaires, to unveil his plans for tackling the nation’s housing affordability crisis. Critics, however, have argued his proximity to the ultra-wealthy undermines his credibility on economic concerns affecting everyday Americans.

“At the end of the day, it's the investors and billionaires at Davos who have his attention, not the families struggling to afford their bills,” said Alex Jacquez of the Groundwork Collaborative, a liberal think tank.

Trump has proposed measures such as reducing mortgage rates by buying $200 billion in mortgage debt and preventing large financial companies from purchasing homes. Yet experts contend such moves barely address the core housing problem: A multi-year shortfall in home construction. Darrell West of the Brookings Institution noted, “Most billionaires don’t share the interests of the working class,” adding that their focus on tax cuts and deregulation makes it challenging to support working families.

At the event, Trump lauded his relationships with billionaires, stating, “The most brilliant people are gathered around this table.” Polls show declining confidence in Trump's ability to lower the cost of living, with just 16% of Americans believing he has improved affordability significantly.

Poll of the day: Riddle me this…

Are things more affordable today than they were a year ago? |

Poll of the day: So long, then, metaverse!

We asked: Are you gonna miss the Metaverse?

You answered:

🟨⬜️⬜️⬜️⬜️⬜️ No. (62)

⬜️⬜️⬜️⬜️⬜️⬜️ No. No. (6)

⬜️⬜️⬜️⬜️⬜️⬜️ No. No. No. (8)

⬜️⬜️⬜️⬜️⬜️⬜️ No. No. No. No. (2)

🟨🟨🟨🟨⬜️⬜️ No. No. No. No. No. (216)

🟩🟩🟩🟩🟩🟩 I'm sorry, what's this Metaverse thing? Can you explain it to me? I still don't understand. Is it like the Internet? (281)

⬜️⬜️⬜️⬜️⬜️⬜️ Yes. (8) 583 Votes

via @beehiiv polls

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |

Need2Know is covered by Cheddar’s Terms of Service