- Need2Know, by Cheddar

- Posts

- Are you using your 401(k) as an emergency fund?

Are you using your 401(k) as an emergency fund?

If so, you're not alone. Plus: The markets are meh about this E.U. trade deal in a "monster week."

Hello, N2K’ers!

We already have (checks notes) more than a dozen quite good entries in Cheddar’s world-famous News Haiku™ competition. The rules? Send me a haiku by Thursday at noon, Eastern, right here. I’ll pick three and let you vote for your favorite on Friday, and we’ll announce the winner on Monday!

Here’s how it works: I’ll suggest a theme based on the news—say, for instance, the bickering between Donald Trump and Fed chair Jerome Powell. Then you’ll write something like this, but much better:

Trump pulls papers out,

"Look, three buildings!" "No... just two."

Powell shakes his head.

I bet you can do better. I know you can. So that’s the theme this week: Trump-Powell. Go!

—Matt Davis, Need2Know Chedditor

News You Need2Know

If you like this newsletter, why not forward it to a friend so they can subscribe here? If you don’t, why not forward to an enemy? Thank you!

What’s the stock market up to, eh?

Companies mentioned in today’s newsletter*

$MS ( ▼ 1.55% ) $TSLA ( ▼ 3.78% ) $SSNLF ( ▲ 55.02% ) $SSNLF ( ▲ 55.02% ) $TSLA ( ▼ 3.78% ) $DIS ( ▲ 2.72% )

*We’re mentioning private companies here now, too.

More Americans treat 401(k) as emergency funds

Americans are rethinking their 401(k)s. Once solely for retirement, these accounts are increasingly becoming go-to emergency funds, leading to significant "leakage" from the $12.2 trillion asset pool, according to Vanguard Group.

Last year, a record 4.8% of workers took hardship distributions, up from a pre-pandemic average of 2%.

“Income volatility is proving a threat to retirement security. It’s a hard thing for people to manage,” said Fiona Greig with Vanguard. Nearly a third of those who leave jobs also liquidate their 401(k)s, often incurring taxes and penalties. These workers, increasingly enrolled automatically in 401(k)s, cash out at significantly higher rates than salaried employees, often to pay off debt after leaving jobs.

This trend can significantly reduce retirement wealth by about 30% over 30 years due to lost compounding. Congress has also played a role, repeatedly making it easier to access these accounts.

Why this shift? For many, immediate financial needs outweigh long-term savings. Timothy Flacke, CEO of Commonwealth, told the Wall Street Journal this weekend: “For many workers, getting through today or this month is the more immediate concern.”

The Power of Compound Interest

— Compounding Dividends (@CompoundingW)

3:48 AM • Jul 18, 2025

Song of the day: Tyler Childers, ‘Oneida’

From his new Rick Rubin–produced album “Snipe Hunter,” “Oneida” is this Kentucky musician’s coming-of-age song (lols) about pursuing an older lady. I just hope she invested $100 a month in the stock market from the age of 25 and that she’s 75 now, because then she would have $1,489,172 to spend on the young fellow.

Free yourself from advertising forever!

Now you can sign up for an optional ad-free version of Need2Know! Subscribe for just $5 a month, or $50 a year, and you can continue to enjoy this reasonably high-quality newsletter uninterrupted. Bonus: The immense satisfaction that comes from supporting journalism*!

From Italy to a Nasdaq Reservation

How do you follow record-setting success? Get stronger. Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year. So adding 10+ new international destinations, including three in Italy, is big. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

*This counts as journalism, right?

Wall street goes “meh” on European tariff deal

Wall Street began the week on a quiet note, despite a U.S.-European trade deal setting tariffs at 15% over the weekend. Many investors had already anticipated a deal, incorporating some of the potential positive impacts into asset prices in the weeks leading up to the announcement.

Meanwhile markets are braced for a monster week of news. There’ll be big tech profit reports, Federal Reserve interest rate decisions, and key economic indicators. “This is about as busy as a week can get in the markets,” Chris Larkin with Morgan Stanley $MS ( ▼ 1.55% ) told the AP.

All eyes are on the Federal Reserve's Wednesday decision regarding interest rates. While President Trump is urging for rate cuts to stimulate the economy, Fed Chair Jerome Powell remains cautious, which you’ll know if you’ve entered this week’s News Haiku™ competition. I mentioned that, right?

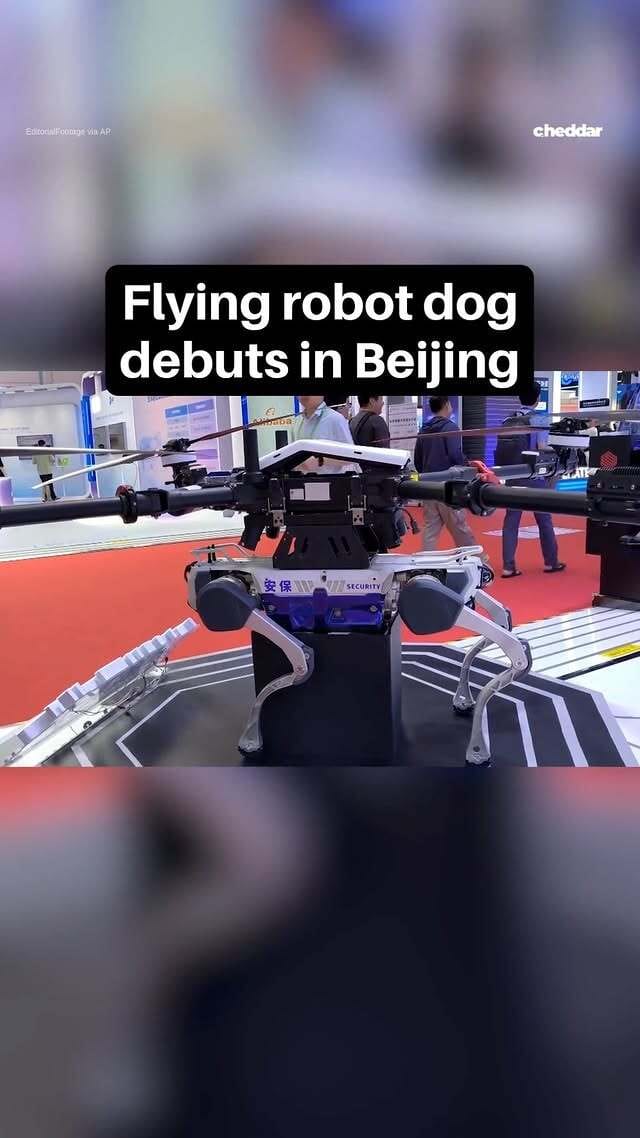

Today on the ‘gram: Woof, flap, flap, weeee!

Post of the day: Tour de fra-aghhhhhh-nce

.@LeTour takes on Montmartre for the first time in history 🚴♂️

— KG (@kgmadeit1)

11:33 PM • Jul 27, 2025

Quote of the Day

How AI might be one way to combat deepfakes

“I’m going to ask you a few questions now.”

As AI advances, so too does its misuse, with deepfakes emerging as a powerful tool for deception. From impersonating government officials in national security threats to infiltrating corporate systems through fake CEOs, deepfake technology is becoming a major challenge in the digital age. But as Vijay Balasubramaniyan with Pindrop Security tells us, "We are going to fight back" — and AI itself may be the key weapon.

Deepfakes have already made headlines for targeting notable figures. This summer, a deepfake of Secretary of State Marco Rubio was used to reach out to foreign officials, seeking sensitive information. On the corporate side, scammers have leveraged synthetic media to imitate CEOs, steal employee credentials, and conduct corporate espionage. “The financial industry is right in the crosshairs,” warns Jennifer Ewbank, a former deputy director of the CIA.

Thankfully, solutions are on the horizon. AI-driven systems like Pindrop’s software can detect subtle irregularities in deepfakes, offering a promising defense. “We’re not going to be subservient to disinformation,” said Balasubramaniyan.

Should you check your 401(k) today?

👍️

Meh, it’s exactly where it was on Friday (which admittedly was an all-time record).

Samsung wins $16.5 billion Tesla AI chip deal

Tesla $TSLA ( ▼ 3.78% ) and Samsung $SSNLF ( ▲ 55.02% ) have inked a landmark $16.5 billion supply deal, marking a significant moment for the chip-making industry in the U.S. and beyond. The deal, which involves Samsung's new chip factory in Taylor, Texas, highlights Tesla's plan to source advanced AI chips for self-driving vehicles and humanoid robots.

“Samsung’s Taylor factory so far had virtually no customers, so this order is quite meaningful,” one analyst told Reuters, putting it mildly.

While production is still years away—expected around 2027 or 2028—analysts note its potential to reduce losses at Samsung. "This could significantly trim Samsung's foundry deficits, which are estimated to exceed $3.6 billion for the first half of the year," noted another analyst.

A majority of N2K readers expect Tesla’s stock to fall in value over the next six months.

'Fantastic Four' tops weekend box office

Looking for an original movie with a great script, superb acting, and an absence of CGI? Go see Wong Kar-wai’s 2000 film “In The Mood For Love” at the IFC in New York City. I was one of three people in there on Monday at 11:30 a.m. It was heavenly. Let’s share an umbrella in the rain, baby!

No? Okay. Marvel’s $DIS ( ▲ 2.72% ) first family has returned in triumphant fashion as “Fantastic Four: First Steps” soared to a $218 million global box office debut, including a $118 million domestic opening. The film, which introduces Pedro Pascal, Vanessa Kirby, Ebon Moss-Bachrach, and Joseph Quinn as the iconic superhero team, has broken past the longstanding box office curse that plagued this franchise’s previous adaptations.

Unlike its predecessors, the 2005 attempt (with a paltry $56M opening) and the 2015 reboot (with a pathetic, useless $25.6M opening), this latest installment has garnered praise from critics and audiences alike. Third time lucky, eh, guys?

Holding an impressive 87% score on Rotten Tomatoes, the film is only 5% lower than the really really good movie I was talking about in my intro. It skillfully blends retro-futuristic adventure with fresh storytelling under director Matt Shakman’s vision. The storyline sees comic book characters Mister Fantastic, Invisible Woman, Human Torch, and The Thing face off against Galactus (Ralph Ineson) and Silver Surfer (Julia Garner), kicking off Phase Six of the Marvel Cinematic Universe.

While DC’s Man of Steel presented stiff, metallic competition with its own $220 million global opening, Marvel proved it could hold its ground.

“In the sunset of dissolution, everything is illuminated by the aura of nostalgia, even the guillotine.” ― Milan Kundera, “The Unbearable Lightness of Being.”

Poll of the Day: Marvel-lous? Or maybe not?

Where are we with all this Marvel CGI movie stuff, then, eh? |

Poll Results: You’re okay with the new Sydney Sweeney jeans ad, thank goodness

The Cut ran a straight-outta-Bushwick cancel culture takedown of the new Sydney Sweeney ad for American Eagle jeans yesterday, describing the ad — which sent the company’s stock soaring — as “fascist” and using “eugenics propaganda” for having the tagline, “great jeans.”

You, dear reader, are a tad more sanguine about all this, and I’m glad to hear it. We asked: What do you think of the new Sidney Sweeney ad for American Eagle?

You answered:

🟩🟩🟩🟩🟩🟩 She's a 27 year old actor and free to market anything she likes. I don't have a problem with it. (379 votes)

🟨🟨🟨🟨⬜️⬜️ I'd prefer it if denim companies could sell their products without resorting to sexist and exploitative advertising like this. (258 votes)

637 Votes via @beehiiv polls

| Want more Cheddar? Watch us!Search “Cheddar” on Samsung, YouTube TV, and most other streaming platforms. N2K is the tip of of the cheeseberg for financial news, interviews, and more. |